- Chocolate in all its delicious forms is one of the world’s favorite treats. Per capita consumption in the U.S. alone averages around 9 kilograms (19.8 pounds) per year. The industry is worth more than $90 billion globally.

- Ingredients — including cocoa, palm oil and soy — flow from producer nations in Africa, Asia and South America to processors and consumers everywhere. But a recent study reveals that large amounts of these commodities are linked to indirect supply chains, falling outside sustainability programs and linked to untraced deforestation.

- Key producers of these commodities — mostly West African countries for cocoa, Brazil for soy, and Indonesia for palm oil — have faced extensive deforestation due to agricultural production, and will likely face more in future as chocolate demand increases.

- Production, transport and consumption of chocolate also have their own environmental impacts, some of which remain relatively understudied. But researchers inside and outside the industry are working to better trace chocolate deforestation, and to make processing, shipping and packaging more sustainable.

Chocolate is a treat beloved across the world. But how much do we know about our favorite guilty pleasure’s environmental impacts?

A recent study, published in the journal Science Advances, sheds light on key ingredients that make their way into many chocolate products — often untraced, and possibly linked to deforestation in Latin America, Africa and Asia.

The study found that high volumes of cocoa, palm oil and soy — key ingredients used in bulk to make some of our chocolate favorites — are currently traded with little to no traceability via indirect supply chains.

The research, led by Erasmus zu Ermgassen from the Catholic University of Louvain in Belgium and TRASE, a data-driven transparency organization, found that traders purchasing these commodities via intermediaries account for “12 to 42% of soy sourcing, 15 to 90% of palm oil sourcing … and 100% of cocoa sourcing.” The use of such middlemen can easily conceal the environmentally harmful, deforestation-causing sources of these commodities.

Each of these commodities is used to make chocolate products. Cocoa, of course, is an essential in all chocolate. Though alternatives to palm oil are increasingly used by some companies, it still appears in a vast number of products to add a smooth texture. Soy, meanwhile, is used in the form of soy lecithin, a derivative, to aid the molding process.

The challenge of accounting for cocoa

Chocolate is big business: Last year, the global chocolate confectionery market was valued at $91.1 billion and projected to reach $106.34 billion in the next five years. In 2018/19, the world consumed an estimated 7.7 million metric tons of chocolate, while Europe remains a vital hub for chocolate production and consumption (in 2019, 3.7 million metric tons of the sweet stuff was made there).

In recent years, the major chocolate companies, in response to public concern, have committed to rooting out deforestation related to production, and to tackling social problems such as child labor in their supply chains. Pressure is mounting now due to pending European Union legislation designed to halt the import of goods linked to deforestation.

Zu Ermgassen and his team investigated the three ingredients commonly found in chocolate: cocoa, palm oil and soy. Together, these crops are among the main drivers of deforestation linked to agriculture planetwide.

Potentially vast amounts of these commodities entering supply chains via indirect sourcing are a major “blind spot” in sustainability schemes, zu Ermgassen’s study reveals. These crops can come with higher, unidentified deforestation risk.

In West Africa, for example, cocoa trees are grown by thousands of smallholder farmers who typically sell their produce to cooperatives or local traders. “[T]here probably is deforestation both in the company’s direct supply chains and in the indirect supply chain,” zu Ermgassen told Mongabay in an interview. “Because even in their direct supply chains, traceability is still very hard … But indirect sourcing is obviously just much less visible, it’s even more difficult to monitor [and] to assess sustainability risks.”

Soy and palm oil: High deforestation risk, low traceability

The lion’s share of the world’s soy is grown in South America, especially in Brazil, where it is considered an indirect driver of deforestation. A voluntary agreement made in 2006 between top commodities companies, environmentalists and the Brazilian government put a moratorium in place starting in 2008 barring the purchase of soy linked to deforestation — a ban that proved successful in slowing the direct conversion of forest.

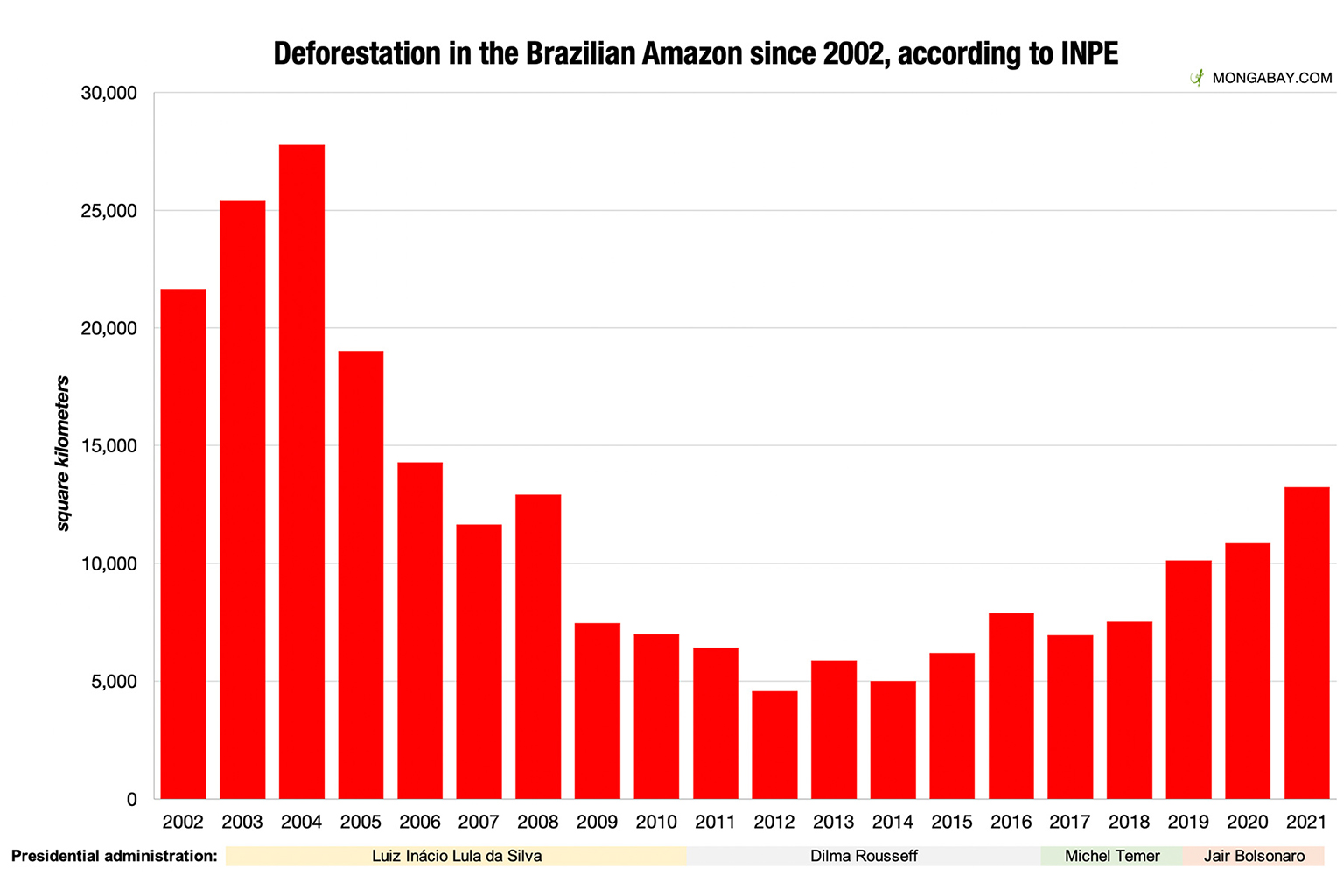

But deforestation has been on the rise in the Brazilian Amazon since 2017, and in 2021 surged to its highest rate since 2008, the year the moratorium went into effect. Forest loss is also rife in the lesser-known Chaco tropical and subtropical dry forest biome (located in Argentina, Paraguay, Bolivia and Brazil), where soy is king.

Some question whether the Amazon soy moratorium’s claims of success have been overblown, because while soy growers don’t directly cause new deforestation, they do typically expand their plantations onto land bought from cattle ranchers who are the prime drivers of deforestation in the Brazilian Amazon. A 2022 report used satellite data to confirm that deforestation is rising in Mato Grosso state in the southeastern Brazilian Amazon, due in large part to industrial soy production.

In recent years, deforestation rates in the palm oil agribusiness sector declined from an extreme peak of 314,937 hectares (778,226 acres) in 2012. A report published earlier this year found that forest loss linked to palm oil in Indonesia and Malaysia (the world’s two biggest palm oil producers), as well as Papua New Guinea, had fallen to a four-year low.

“What we’ve seen, at least in the palm oil sector, is that the larger-scale deforestation events are really in … large concessions,” said Janina Grabs, an assistant professor in the Department of Society, Politics and Sustainability at the ESADE Business School in Barcelona. But even in large concessions, “we do see signs that corporate actors are changing their plans and changing their strategies in response to pressure from their supply chain.”

“On the smallholder farms, the story is a little bit different in the palm oil industry, and I would say this holds for cocoa as well,” Grabs continued. “There are many more problems [with smallholders] in even just tracing supply chains, which is the first step to actually guaranteeing a deforestation free supply.”

Indirect supply risks continue to undermine national zero-deforestation targets in producer countries because companies cannot account for the sourcing of their goods.

Expanding cocoa production in Africa

There is no chocolate without cocoa. Today, Côte d’Ivoire and Ghana are the world’s major producers, accounting for around 60% of global supply. Though that is likely to change in coming years due to climate change and exhausted croplands.

Cocoa plantations have already consumed vast swaths of forest in both these African countries. Ghana has lost an estimated 65% of its forest and Cote d’Ivoire more than 90% in the last thirty years, much of this linked to cocoa, reports NGO MightyEarth. According to the World Bank, only around 9% of Côte d’Ivoire’s forest cover remains, down from 20% in 1995. The World Cocoa Foundation, an industry group,* claims that just 25% and 8% of primary forest was lost in Côte d’Ivoire and Ghana respectively between 2002 and 2019. A “significant portion” of this tree loss, they agree, was linked to cocoa farm expansion.

“One of the main reasons given for such high rates of degradation is the transformation of forest areas (including protected areas) into cocoa plantations, which represent 38% of the direct drivers of deforestation,” Kerry Daroci, cocoa sector lead at the Rainforest Alliance, told Mongabay.

The report by Mighty Earth released earlier this year states that deforestation continues apace in these cocoa-growing African states, with 19,421 hectares (47,990 acres) of forest lost in Côte d’Ivoire and 39,497 hectares (97,599 acres) in Ghana since 2019.

Not all this deforestation is driven by cocoa, notes Samuel Mawutor, senior adviser at Mighty Earth. But low cocoa yields and low prices (which cause farmers to want to grow more), and the wearing out of older farmlands, contribute to cocoa crop expansion into forested areas, he explained. “[T]here is that pressure on farmers to expand the farms to be able to make more from cocoa production.”

Ethan Budiansky, senior director of environment at the World Cocoa Foundation, disputes these figures. “[W]ithin WCF, working with other technical experts and the governments as well, we’re coming forward with better data and analysis than the Mighty Earth report.”

Despite conflicting data, experts still broadly agree that the indirect cocoa supply chain is where the majority of deforestation is likely occurring, particularly placing protected areas at risk. A 2021 study estimated that about 20% of cocoa farms in Ghana and Côte d’Ivoire are inside protected areas. Côte d’Ivoire’s Conseil du Café-Cacao, a regulatory body, estimates that 15% of the nation’s cocoa farms are in conserved areas.

“Cocoa from all these places still find its way into the supply chain. There is no means of eliminating any of [it],” Mawutor declared.

With so much deforestation already occurring due to the cocoa crop, climate change could further accelerate existing plantation expansion. In fact, growers are already feeling the effects, Mawutor said, with scorching temperatures threatening cocoa trees, and requiring farmers to grow more elsewhere.

Models suggest that in the near future suitable cocoa-growing areas in the two major producing countries could shrink, with Congo Basin nations likely to become the next prime cultivation spots, possibly displacing other types of farms and leading to deforestation of biologically sensitive areas.

“[P]eople say that there’s little left to deforest in Côte d’Ivoire and Ghana, but that doesn’t mean it’s not going to happen somewhere else,” notes Marieke Sassen, senior researcher in Earth informatics and plant production systems at Wageningen University in the Netherlands. She led the 2022 study suggesting that ecologically important areas of West Africa may become more suitable for cocoa production as climate change progresses.

“There’s a risk that cocoa-driven deforestation in Côte d’Ivoire and Ghana will expand to still forested countries, including Liberia, Cameroon and other Congo Basin countries that seek to develop their cocoa sector,” she said.

The industry is well aware of the problem that expansion poses, said Budiansky. “The reality is that we’re not in a space of business as usual … The real risk is, that with climate change or not, the expansion of cocoa into new areas” is likely, he said.

“That’s where — in areas like the Congo Basin, in particular — we want to be more proactive with ensuring that forests are protected first and foremost,” he said. In that way, “any new cocoa production that does happen, happens in a smart way.”

In a Mongabay report published in February, researchers warned that expanding cocoa farms in the Democratic Republic of Congo are already contributing to deforestation.

The future of cocoa: Tracing supply chains, better transparency

“Traceability is a major step towards compliance and zero deforestation within the direct supply chain,” stated WCF’s Budiansky. According to the Cocoa and Forests Initiative, a collective of governments and private industry, 82% and 74% of cocoa from companies’ direct supply chains in Côte d’Ivoire and Ghana, respectively, are currently traceable. In practice, however, it is estimated that only around half of cocoa from these two countries is sourced directly, with the other half being indirectly sourced, with those beans purchased via local traders or cooperatives, and with traceability continuing to be a significant challenge.*

To tackle the indirect supply problem, Budiansky points to new national traceability systems, developed by the Côte d’Ivoire and Ghana governments. “With the establishment of a national traceability system in both countries, the idea is to bring [tracking] all under one roof [and focus] that level of traceability down to the farm level.”

Such systems are a “welcome development,” agreed zu Ermgassen. “[B]ut it’s important that they be transparent. It’s a question of incentives. Currently, a lot of cocoa is non-compliant. If the traceability systems are an [impenetrable] black box, then there will be little incentive for the government and companies to reveal the pathway to market for non-compliant cocoa.”

Other deforestation solutions within the direct supply chain focus on offering farmer assistance programs to improve livelihoods and increase incomes, and on satellite monitoring systems for measuring forest cover change, efforts similar to those used to tackle deforestation on oil palm plantations.

“Using technologies, such as satellite tree cover imagery and geolocation data, the risks of deforestation are more easily identified and can be addressed,” said Rainforest Alliance’s Daroci.

Agroforestry, too, is high on the sustainability agenda. Chocolate companies have distributed millions of new cocoa trees in an effort to reforest farms, stepping away from the full-sun growing method favored for many years.

Partial- and full-shade cocoa growing improves sustainability by reducing the need for fertilizer and pesticide, and “ideally improves productivity,” said Budiansky. It also “makes that cocoa farm last for a longer period of time, before it has to be rehabilitated and, ideally, keeps that farmer on that plot of land, instead of needing to expand into other areas.”

Questions remain, however, over how productive cocoa farms grown under agroforestry systems truly are. “Agroforestry systems, if well managed, are very sustainable systems,” explained Laura Armengot, a senior scientist at the Research Institute of Organic Agriculture (FiBL) in Switzerland.

But lower agroforestry yields can prompt farmers to clear more land to make up for production shortfalls, she continued. “To solve this, it is essential to increase cacao productivity in agroforestry systems” via the use of “improved high-yielding cacao planting material with low susceptibility to diseases.”

Experts agree that agroforestry marks an essential shift for cacao farmers, if the industry is to reduce its environmental impacts, build climate resilience, and increase biodiversity. But even if that change occurs on a large scale, agroforestry alone won’t end the deforestation plaguing the sector.

“What stops deforestation is implementation or enforcement of forest protection laws and/or providing people with incentives to stop expanding by supporting increased agricultural productivity, but also, for example, through payments for environmental services,” said Sassen.

Counting up chocolate’s life-cycle environmental cost

Deforestation isn’t the sum total of chocolate’s harm. Researchers are analyzing the entire chocolate life cycle, from production and transport, through packaging. This approach, — known as the life cycle assessment, or LCA, allows environmental hotspots along the chain to be identified.

In 2018, researchers estimated that the United Kingdom’s chocolate industry emits around 2.1 million metric tons of CO2 equivalent per year to satisfy consumer demand. The major hotspots identified were raw materials, chocolate production, and packaging.

They found that it is not only ingredients such as cocoa, soy and palm oil that have an impact, but others too, such as milk powder and sugar, said Adisa Azapagic at the University of Manchester’s Department of Chemical Engineering, who led the research.

David Pérez-Neira, a professor at Spain’s University of León, targets “energy inefficient” truck and van transportation as a “major phase contributing to [chocolate’s] environmental impacts.” Cocoa imported into Europe, for example, is often processed and then reexported in various final forms, adding to the long global path from cropland to consumer and to the overall environmental burden.

Research led by Pérez-Neira and Armengot from FiBL found that the environmental gains of growing organic cocoa — including lower emissions, reduced fertilizer and less energy use — can in some instances be wiped out by long transport distances and reexports.

“The study focuses on Ecuador [as a source], but it is only an example, and we would have reached the same results with data from other locations,” Armengot said. “With this study we wanted to raise awareness that for consuming sustainable chocolate, being ‘organic’ is necessary, but maybe it is not enough.”

Packaging has its own story to tell. On average, it’s estimated that every kilo of chocolate produced results in around 3.8 kilos of CO2 emissions. In a study released earlier this year, researchers found that chocolate packaging generally accounts for around 10% of these emissions, but that proportion can rise to up to nearly 30%, depending on materials used.

That’s just looking at climate change impacts, stressed study lead Victoria Krauter, a packaging and sustainability specialist at the University of Applied Sciences in Vienna. Other impacts, such as eutrophication, could flesh out this analysis.

Thorough life cycle analysis is vital if potential “efficiencies” are to be pinpointed and implemented, researchers say. Agroforestry and organic systems can reduce chocolate’s production footprint, and so can processing chocolate before importation, along with more efficient transportation and greater electrification of vehicles, said Pérez-Neira.

“All these efficiency measures will improve sustainability, but at the same time, we need a change in the agrifood model,” concluded Armengot. “Globalized food should be an exception and not the norm on our plates.”

Even after chocolate is mixed, molded, wrapped, packed, shipped and sold, its environmental journey isn’t over. Caffeine is part of what makes some chocolate concoctions so wonderful, tickling our tastebuds and firing the pleasure center of our brains. But once expelled from our bodies, caffeine can make its way into waterways and estuaries via wastewater, from which it is only partially removed.

Caffeine is considered an “emerging contaminant of concern,” found in bodies of water across the world by a recent global study. Our chocolate fix, along with our burgeoning coffee and caffeinated beverage habits, are increasing the impacts of this toxic burden in largely unexamined ways, with impacts on aquatic species and ecosystems. The way forward for dealing with caffeine pollution remains unclear.

What is clear is that chocolate not only puts a smile on our faces and inches on our waistlines — it impacts the greater world in which we live.

Banner image: A farmer cuts cacao pods from the tree in Colombia. Image by Thomas Cristofoletti/USAID via Flickr (CC BY-NC 2.0).

Update 8/3/22: This story has been updated to provide two clarifications: first, noting that the World Cocoa Foundation (WCF) is an industry group, and second, that the deforestation statistics provided by the Cocoa and Forests Initiative only address direct supply chain cocoa sourcing in Côte d’Ivoire and Ghana, but not the approximately 50% due to indirect sourcing.

Related audio from Mongabay’s podcast: A growing proportion of chocolate is produced via agroforestry, the most climate- and biodiversity-positive form of agriculture, which is growing in popularity worldwide, click the play button to listen here:

Citations:

zu Ermgassen, E. K., Bastos Lima, M. G., Bellfield, H., Dontenville, A., Gardner, T., Godar, J., … Meyfroidt, P. (2022). Addressing indirect sourcing in zero deforestation commodity supply chains. Science Advances, 8(17). doi:10.1126/sciadv.abn3132

Heilmayr, R., Rausch, L. L., Munger, J., & Gibbs, H. K. (2020). Brazil’s Amazon soy moratorium reduced deforestation. Nature Food, 1(12), 801-810. doi:10.1038/s43016-020-00194-5

Abu, I., Szantoi, Z., Brink, A., Robuchon, M., & Thiel, M. (2021). Detecting cocoa plantations in Côte d’Ivoire and Ghana and their implications on protected areas. Ecological Indicators, 129, 107863. doi:10.1016/j.ecolind.2021.107863

Sassen, M., van Soesbergen, A., Arnell, A. P., & Scott, E. (2022). Patterns of (future) environmental risks from cocoa expansion and intensification in West Africa call for context specific responses. Land Use Policy, 119, 106142. doi:10.1016/j.landusepol.2022.106142

Niether, W., Jacobi, J., Blaser, W. J., Andres, C., & Armengot, L. (2020). Cocoa agroforestry systems versus monocultures: A multi-dimensional meta-analysis. Environmental Research Letters, 15(10), 104085. doi:10.1088/1748-9326/abb053

Konstantas, A., Jeswani, H. K., Stamford, L., & Azapagic, A. (2018). Environmental impacts of chocolate production and consumption in the UK. Food Research International, 106, 1012-1025. doi:10.1016/j.foodres.2018.02.042

Pérez-Neira, D., Copena, D., Armengot, L., & Simón, X. (2020). Transportation can cancel out the ecological advantages of producing organic cacao: The carbon footprint of the globalized agrifood system of Ecuadorian chocolate. Journal of Environmental Management, 276, 111306. doi:10.1016/j.jenvman.2020.111306

Krauter, V., Bauer, A., Milousi, M., Dörnyei, K. R., Ganczewski, G., Leppik, K., … Varzakas, T. (2022). Cereal and confectionary packaging: Assessment of sustainability and environmental impact with a special focus on greenhouse gas emissions. Foods, 11(9), 1347. doi:10.3390/foods11091347

Wilkinson, J. L., Boxall, A. B., Kolpin, D. W., Leung, K. M., Lai, R. W., Galbán-Malagón, C., … Teta, C. (2022). Pharmaceutical pollution of the world’s rivers. Proceedings of the National Academy of Sciences, 119(8), e2113947119. doi:10.1073/pnas.2113947119

Vieira, L. R., Soares, A. M., & Freitas, R. (2022). Caffeine as a contaminant of concern: A review on concentrations and impacts in marine coastal systems. Chemosphere, 286, 131675. doi:10.1016/j.chemosphere.2021.131675

FEEDBACK: Use this form to send a message to the author of this post. If you want to post a public comment, you can do that at the bottom of the page.