- Governments across Southeast Asia have embraced billions of dollars in construction projects backed by China as they rely on infrastructure-building to drive their economic growth.

- But there are worries that this building spree, under China’s Belt and Road Initiative (BRI), makes no concessions for environmental protections, and even deliberately targets host countries with a weak regulatory climate.

- Beijing has also been accused of going on a debt-driven grab for natural resources and geopolitical clout, through the terms under which it lends money to other governments for the infrastructure projects.

- In parallel, China is also building up its green finance system, potentially as a means to channel more funding into its Belt and Road Initiative.

KUCHING, Malaysia — As governments in Southeast Asia target economic growth through infrastructure development, China, the world’s second-largest economy, has emerged as a ready funder for some of the most ambitious and expensive projects.

Regional leaders have been quick to seize the opportunity offered by Beijing, but environmental experts warn that many of these projects could cause irreversible environmental damage in highly biodiverse areas.

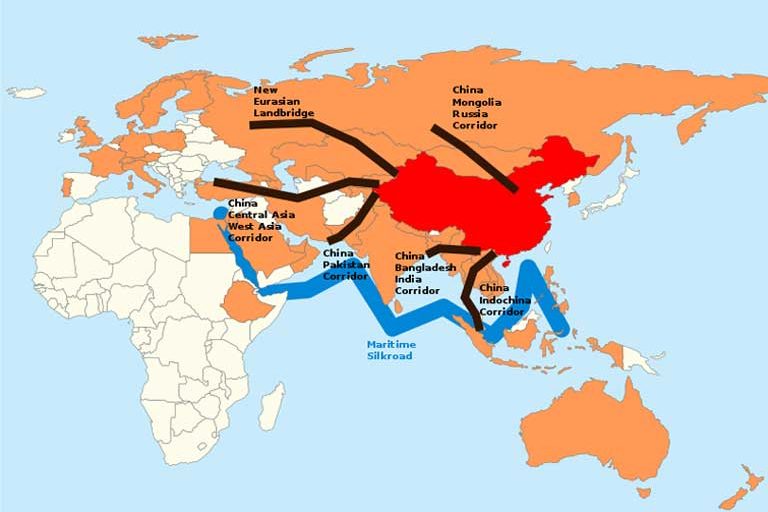

The infrastructure push has come in two waves this past decade, both aimed at establishing new roads, ports and railways across the region in pursuit of improved trade and logistics. In 2010, the Association of Southeast Asian Nations (Asean) announced its Master Plan for Connectivity, which seeks to boost regional integration among the 10 member countries of the bloc through infrastructure projects. Three years later, China inaugurated its Belt and Road Initiative (BRI), a $1 trillion transportation and energy infrastructure construction juggernaut aimed to give Beijing a strong presence in markets across the region as well as Africa and Europe. The initiative is slated for completion in 2049.

Overall, these and other initiatives would see paved roads in Asia’s developing nations double in length in the next few years, according to a 2017 report.

Asean is one of China’s largest trading partners, and given its vast natural resources and geographical proximity to China, the association of fast-growing nations is a key priority for the BRI.

More than 60 percent of Chinese overseas direct investment (ODI) to BRI countries from 2013 to 2015 went to Asean member states, according to The Economist Intelligence Unit. China’s total ODI in BRI countries was $21.4 billion in 2015, up from $13.6 billion in 2014 and $12.6 billion in 2013. Much of this money has gone to finance large, and often highly controversial, infrastructure projects.

One of them, for instance, is a high-speed rail line in Indonesia, which the government in Jakarta shelved due to a lack of proper environmental impact studies and conflicts with local zoning plans. Also in Indonesia, a massive dam project supported by the Bank of China and Sinohydro, China’s hydropower authority, has been widely criticized for threatening the only known habitat of the world’s rarest great ape, the Tapanuli orangutan.

There have also been complaints in Laos, Vietnam and Cambodia about potential damage to the environment and communities from Chinese-backed hydropower projects along the Mekong River.

What’s at stake?

The BRI may appear to be an ambitious take on globalization, by covering 68 countries through trade and commerce and linking them to China, but there’s more to it than that, says Mason Campbell, a postdoctoral research fellow at the Centre for Tropical Environmental and Sustainability Science at James Cook University in Australia.

“It’s basically under the guise of internationalizing China, but it’s more about resource extraction and attaining materials,” Campbell told Mongabay on the sidelines of the 2018 conference of the Association for Tropical Biodiversity Conservation in Kuching, Malaysia, in early July.

Campbell, whose work has focused on the Pan Borneo Highway — a project to linking the two Malaysian states on the island with the nation of Brunei — said China’s way of asserting its influence in most infrastructure projects was typically by pushing for Chinese companies to work abroad or finance a development project in a foreign country that would eventually benefit China.

China has pursued minerals, fossil fuels, agricultural commodities and timber from other nations under this model. As a net importer of coal, Chinese firms have 700 plants scheduled to be built by 2027, a fifth of which will be located abroad, including in Southeast Asia. The country is also investing $100 billion annually in Africa for extractive mineral industries and the associated transportation and energy infrastructure. The effort to secure these resources has spawned its own infrastructure boom that typically involves building large-scale roads, railways and other infrastructure to transport commodities from interior areas to coastal ports for export.

In an analysis that only considers the backbone BRI projects, and not these various side projects, the WWF estimates that the Chinese initiative will directly impact 265 threatened species, including endangered tigers, giant pandas, gorillas, orangutans and Saiga antelopes.

“There is significant potential overlap between the terrestrial BRI corridors and areas that are important for biodiversity conservation and for the provision of social and economic benefits to people,” the wildlife NGO wrote in the report. “These overlaps indicate risk areas for potentially negative impacts of infrastructure development.”

It said the major BRI corridors would cut through or broadly overlap with 1,739 Important Bird Areas or Key Biodiversity Areas, as well as 46 biodiversity hotspots or Global 200 Ecoregions.

“It’s huge. It’s as big as oil palm,” Alex Lechner, a researcher from the School of Environmental and Geographical Sciences at the University of Nottingham Malaysia Campus, told Mongabay.

In a report published earlier this year, Lechner highlighted the rampant biodiversity loss in Asia from the BRI, which crosses several terrestrial and marine biodiversity hotspots, wilderness areas and other key conservation areas, such as Southeast Asia’s Coral Triangle.

Road development, the report said, will create direct and indirect impacts, such as habitat loss, fragmentation, and illegal activities such as poaching and logging. In the marine environment, increased sea traffic exacerbates the movement of invasive species and pollution. Poorly planned infrastructure has the risk of locking in undesirable environmental practices for decades to come, it added.

“BRI could have disastrous consequences for biodiversity,” Lechner wrote in the report.

New player, old game

China is not the only nation promoting its own economic interests over those of other countries and their environmental health. It’s a story that has played out going back to the colonial period and earlier, when European nations ruthlessly exploited the resources and people of Africa, Asia and the Americas.

The difference with China is both scale and speed, says William Laurance, a professor at James Cook University, whose work in the past two decades has primarily focused on infrastructure projects and their impact on the environment.

“No nation has ever changed the planet so rapidly, on such a large scale, and with such single-minded determination,” Laurance wrote in an op-ed last year. “It is difficult to find a corner of the developing world where China is not having a significant environmental impact.”

He also noted that China currently lacks other key factors that would make it easier to track and mitigate the impacts of projects, such as a free press or laws regulating the practice of Chinese businesses abroad.

According to a major World Bank analysis of nearly 3,000 projects, Chinese foreign investors and companies often predominate in poorer nations with weak environmental regulations and controls. This, Laurance said, makes those nations prime “pollution havens” for China and Chinese enterprises, as the latter wouldn’t take any blame for the environmental damage wrought by their activities in the host countries.

Mohammed Alamgir, an environmental scientist at James Cook University, described China’s BRI as also a way of buying long-term political influence across the globe.

“In this arena of political economy, this huge investment from China, they’re the only player in that field,” he said.

Campbell said the political favors sought by China would become clearer once the country receiving the funding for infrastructure projects struggled to pay back the money. A prominent case is that of the $1.5 billion Hambantota port in Sri Lanka. With the host government overleveraging itself to finance the project, it has had to give China a 99-year lease on the port in exchange for debt relief.

The scale of China’s international resource exploitation is only likely to increase. The Beijing-backed Asian Infrastructure Investment Bank (AIIB), the primary investor in BRI projects, is heavily capitalized and moving rapidly to fund overseas projects with “streamlined” environmental and social safeguards. However, the host nations can, in theory, negotiate for much stringent standards for individual projects.

In the meantime, the World Bank in 2016 announced new environmental and social safeguards to remain competitive with the AIIB. But those new standards have been described by some experts, including Laurance, as weaker than the lender’s previous framework.

Laurance said the AIIB and other Chinese development banks could force a “race to the bottom” among multilateral lenders — with potentially grave consequences for the global environment.

In 2016, Chinese President Xi Jinping called for a “green, healthy, intelligent and peaceful” Silk Road. He said the participating countries should “deepen cooperation in environmental protection, intensify ecological preservation and build a green Silk Road.” Over the past decade, Chinese government ministries have released a series of “green papers” outlining lofty environmental and social guidelines for China’s overseas ventures and corporations.

But researchers remain skeptical about this commitment.

“The Chinese government readily admits that compliance with its guidelines is poor, but accepts no blame for this. Instead, it insists that it has little control over its corporations and blames the host nations themselves for not controlling Chinese corporations more carefully,” Laurance said.

“If China really wanted to reign in its freewheeling corporations, it could easily do so by making some strong official statements and visibly punishing a few extravagant sinners. It hasn’t done this for one simple reason: Despite their often-egregious environmental activities, China’s corporations operating overseas are enormously profitable.”

Alamgir said there was still hope for China to improve its environmental commitment by imposing more stringent strategic environmental assessments throughout the project development and funding processes.

“At the end of the day, it’s political will,” he said. “If the Chinese government had the political will to do that.”

Lechner called for more scientists from the global conservation community to look into the environmental impacts of the BRI, and conduct joint research with colleagues in China to better understand the dynamics of the initiative. He said researchers in China had produced about 90 papers reviewing the BRI, but they were in Chinese and only a small percentage were related to environmental aspects.

“I think there’s a lot to be learned about what’s happening internally [in China], because maybe we think [that] it’s a vacuum because it’s not in English, but maybe there are things going on internally,” Lechner said.

Green finance framework

In parallel with the BRI push, China appears to be developing its green financing system. A discussion involving 120 policymakers, financial regulators and practitioners from more than 35 countries in Asia, Africa and Latin America took place in China in May.

The six-day event was also attended by experts from more than 50 international organizations and commercial entities, including the Asian Development Bank, the Climate Bonds Initiative and the Commercial Bank of China. It highlighted Chinese roadmaps for green financial systems and the barriers related to regulatory policies, green definitions, raising awareness, building capacity, and collecting data.

“It was extremely important for senior government leaders at the highest level to send a strong policy signal to regulators and market participants on the importance of green finance to the economy,” said Ma Jun, director of the Center for Finance and Development at Tsinghua University in Beijing, who also led the drafting of China’s green finance guidelines in 2015-2016.

Sean Kidney, CEO of Climate Bond Initiatives, said the green bond market has taken off in the past couple of years, with China and the United States leading the global market.

The Chinese experience, Kidney said, demonstrates that developing a clear green bond taxonomy, verifiers, and disclosure rules will help avoid the problem of greenwashing and also paves the way for smooth accreditation and verification of bond issuances and proceeds management.

Financial institutions based in Shanghai are also seen driving green finance through product innovation, according to Clair Liu, head of international business at the Shanghai Stock Exchange. She cited the exchange’s experience in promoting environmental information disclosure, green bonds, and a green index development.

To achieve a successful green financial system, Ma called on governments to do more to encourage private capital, and to train and develop human resources in the sector.

“Policy coordination among ministries, development of taxonomies, and information disclosure are also key to success,” said Ma, whose current research priorities include investment in the BRI.

Clarification: This article has been updated to amend an incorrect figure. It previously stated that Chinese companies would build 1,600 coal plants by 2027. We apologize for the error.

Editor’s note: William Laurance is a member of Mongabay’s advisory board.

FEEDBACK: Use this form to send a message to the author of this post. If you want to post a public comment, you can do that at the bottom of the page.