- Valuing nature as a “new asset class” could be the key to getting trillions of dollars in investments to flow to nature-based solutions, experts said at a recent sustainability conference in Singapore.

- Because policymakers and investors haven’t been able to properly value nature, the finance industry has been using carbon markets as a proxy for investing in it.

- Governments should account for the ecosystem benefits of nature beyond carbon capture, the experts said.

- Proper valuation of nature’s benefits requires inputs from not only investors, but also scientists, communities and NGOs.

SINGAPORE — Putting a value on nature could be the key to getting the trillions of dollars in investments nature-based solutions need to successfully tackle the climate crisis, experts said at a sustainability conference in Singapore in September.

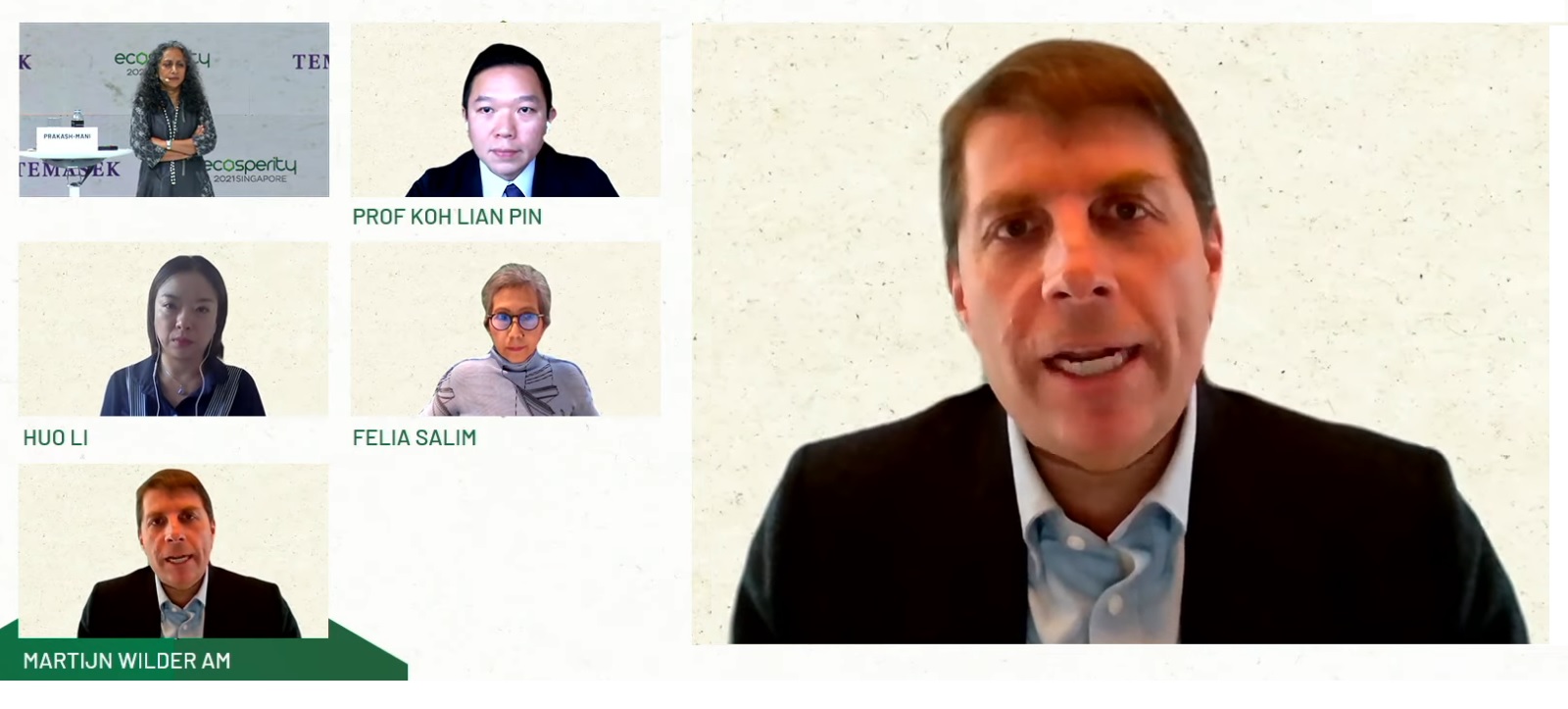

According to a May report by the United Nations Environment Programme, the world needs about $8.1 trillion of investment in nature by 2050 to handle the interlinked climate, biodiversity and land degradation crises. To facilitate investments in nature-based solutions, policymakers and investors need to recognize nature as a “new asset class,” Martijn Wilder, founding partner at climate advisory firm Pollination Group, said at the Ecosperity event convened by Temasek, Singapore’s state investment firm.

“[Today] we’re sort of tinkering at the edges, so carbon is the proxy for investing in nature … but those projects will not drive the [trillions] we need,” he said during a Sept. 29 panel on “Asia’s Nature-based Climate Solutions”. “We need to think of nature as the world’s critical infrastructure that holds the economy together, and we need to be able to place a value on doing that.”

Currently, investments in nature-based solutions are largely driven by carbon offsets projects. Nature-based solutions focus on protecting, managing and restoring forests, wetlands and other ecosystems. Because such projects soak up carbon from the atmosphere, they also produce carbon credits — which can then be sold to companies looking to offset their emissions.

Firms pledging to hit net-zero emissions and strengthen their environmental, social and governance commitments have been boosting demand for such nature-based credits. In 2019, nature-based credits were three times pricier than renewable energy ones in voluntary carbon markets, with companies willingly paying a premium for the co-benefits nature-based projects tend to bring about, such as community economic development and biodiversity conservation.

Such trends have made investing in nature-based projects more attractive than ever, but focusing purely on carbon credits misses a bigger opportunity, Wilder said.

‘It’s ultimately a public good and it’s public spending’

One example of valuing nature’s broader benefits beyond carbon capture is the Land Restoration Fund in Queensland, Australia, which takes into account additional ecosystem services provided, Wilder said.

“They paid individuals who would undertake activities to reduce carbon, pay for the carbon credits, and then on top of that, they would layer additional payments for things like watershed benefits, and koala [habitat restoration],” he said.

“So ultimately, if you as a country value [and] think these are important issues to fund, then the government can either fund it themselves, or it could pay the private sector to undertake these services … it’s ultimately a public good and it’s public spending,” he added.

For developing countries lacking in financial resources, innovative finance products — such as forest bonds allowing investors to opt to be paid in carbon credits rather than cash, and debt for nature swaps — could help unlock sufficient capital to invest in nature, Wilder said.

When it comes to cash-poor but forest-rich Southeast Asia, nature-based solutions could facilitate the transition to a cleaner and greener economy. While the region’s political instability has put off investors, it has some of the highest concentrations of the most profitable carbon projects in the world.

“Based on very conservative carbon pricing scenarios … [projects in Asia Pacific] can generate a return on investment at close to $25 billion in net present value per year, every year, for the next 30 years,” said Lian Pin Koh, director of the Centre for Nature-based Climate Solutions in Singapore and another speaker on the panel. “Indonesia alone can generate about $10 billion per year.”

As an archipelagic region, Southeast Asia naturally tends toward protecting or rehabilitating blue carbon ecosystems such as mangroves, Koh said. There are a host of benefits: not only do mangroves sequester up to four times as much carbon as rainforests, they also serve as natural infrastructure that, alongside human-engineered solutions, can help countries deal with the threat of rising sea levels and increasingly frequent extreme weather events.

‘Not something your conventional banker would understand’

Despite nature’s tangible benefits, getting robust cost-benefit data is challenging, said Huo Li, deputy director of corporate engagement at The Nature Conservancy’s China program, and a third speaker. Another concern is ensuring such projects respect local Indigenous communities’ rights, and tap into their knowledge of the land in tackling the climate crisis, she added.

Felia Salim, a fourth speaker and board member at &Green Fund, which invests in sustainable commercial agricultural projects, said the Dutch foundation had achieved some success in valuing more abstract gains, such as return on the environment and return on social inclusion.

“This is … not something your conventional banker would understand doing, but that’s why there are so many other stakeholders,” Salim, who also used to be managing director of the Jakarta Stock Exchange, said. She added that scientists, community organizers and NGOs had been involved.

Governments and organizations are also working to quantify nature’s benefits, albeit on a broader scale. The United Nations, European Union and developing countries including India and China have an ongoing initiative that aims to advance ecosystem accounting frameworks.

Earlier this year, technology hub Shenzhen became the first city in China to calculate its total gross ecosystem product, a measure that places a value on all goods and services produced by ecosystems.

With three main categories — marketable ecosystems goods and services, such as fishery and agriculture products; nonmarketable services, such as carbon-sequestering forests; and cultural tourism benefits — it aims to incentivize officials to enhance, and not exploit, the environment.

Putting a price on nature could lead to more investments in not only nature-based solutions, but also nature-positive business models, which curb emissions while preserving natural resources.

In a report by Temasek, the World Economic Forum and consulting firm AlphaBeta released during the conference, researchers found the biggest barrier to investing in nature-positive business solutions has been the insufficient pricing of negative externalities, such as pollution and loss of biodiversity and ecosystem services.

Worldwide, negative environmental externalities cost an estimated $4.7 trillion every year, but are seldom accounted for, the report said.

Factoring these externalities into the prices of goods and services would help make nature-positive business models with higher initial costs more attractive investments compared with the business-as-usual nature-negative models, the researchers said.

Banner image of a koala by Ted Lester via Flickr (CC BY-NC 2.0).

FEEDBACK: Use this form to send a message to the author of this post. If you want to post a public comment, you can do that at the bottom of the page.