Challenges facing green business start-ups

mongabay.com

October 20, 2008

While green design offers the potential to greatly improve the sustainability of new goods and services without sacrificing performance, developing and bringing such products to market is a challenge, said a panel of innovators from companies using nature as inspiration for new technologies.

Speaking at the 2008 Bioneers conference in San Rafael, California, Stephen Dewar of WhalePower, Charles Hamilton of Novomer, and Jay Harman of PAX Scientific told biomimicry expert Jane Benyus that radically new approaches to solving design and engineering problems is often met with skepticism from the existing market.

“When you come along with a ‘game-changing’ design, you come across as a nutcase,” said Harman, whose company that develops highly efficient industrial equipment based on patterns found in nature.

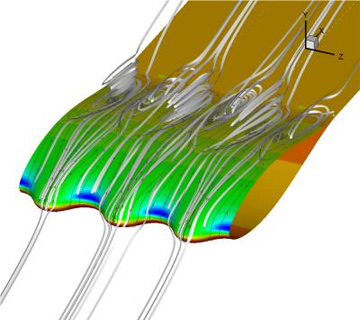

“People said we were crazy… the conventional wisdom was, ‘this can’t be done'” added Dewar, referring to when his company presented turbine makers with designs resembling the bumpy fins of the humpback whale. “But the wind tunnel results suggested otherwise.”

Beyond the initial skepticism about their technologies, the panelists said once a promising material or design had been developed, one of the greatest challenges was identifying and focusing on a market to pursue.

Humpback whale in Alaska

|

Harman said that PAX Scientific identified more than 500 distinct industries where its more efficient fans and turbines could have a significant impact but that it took nearly a decade to narrow these down to a handful of target industries where there would be the least obstacles and pushback.

Hamilton agreed, saying that as a small company “the challenge of focus is absolutely critical”. Hamilton’s Novomer is producing biodegradable plastics that use carbon dioxide as a feedstock.

Dewar noted that even once a market is identified it can be tricky to determine the best point of entry. He said WhalePower had to decide whether to pursue new wind turbine production or target retrofits of existing turbines. The company isn’t big enough to pursue both markets and finding qualified engineers and technical workers is a major hurdle.

Running a startup operation with an unproven technology also makes scaling — and therefore affordability — a challenge. Meeting the production needs of a big customer can be a tall order for a small shop.

Hamilton cited the plastics industry which makes up to 400 billion tons of material per year as an example. To sell a big consumer, his firm has to demonstrate scale and value, neither of which can be done overnight.

“When you tell a big materials consumer that you have a totally new way to produce something, the first thing they want to know is how much you can make at what cost on what time frame,” he said. “As a small company we can’t make things cheaply. It takes time and scale to do that. We can’t build a 100 billion ton plant.”

Hamilton said Novomer was focusing initially on selling high-cost, high-performance materials to very targeted customers.

Harman said the commodification of products has also complicated the picture in that a company can’t count of the “greeness” of a product as a selling point unless you aim to target a niche market.

“We can build a computer fan that is considerably better than any fan in the world today,” he said, noting that a 10 percent gain in efficiency at a server farm can save a company $750,000 per year in energy. “But fan industry is old and everything is commoditized.” Harmon says that virtually all computer fans are made in China on a massive scale at the absolute lowest prices, making it difficult to compete on price.

“When you come up with a new technology, you have patent costs, research costs,” he explained. “Now you can’t position yourself as a commodity product.”

“A company will say, ‘We love your product. How much of a discount can you give me over your biggest competitor?'”

However Harman said the attitude is changing due to rising concerns about the environment.

“Since Inconvenient Truth truth we have seen a major shift,” Harman said. “It had been a battle for previous 10 years.”

Hamilton agreed that until the past 12 months it was just the media and boards of companies talking about carbon, but now middle managers — the people who control budgets — are making decisions based on potential carbon prices. Still Hamilton and Harman say that companies need to design products that perform on their own without the assumption of benefits from the carbon market.

“Your technology needs to stand on its own not because of subsidies called carbon credits,” said Harman.

“To reach the masses you can’t market greeness, but price and performance,” added Hamilton. “If price and performance are there, the market will drive sales.”

Dewar, Hamilton, and Harman also discussed a range of other topics — including their technologies — at the annual Bioneers meeting.