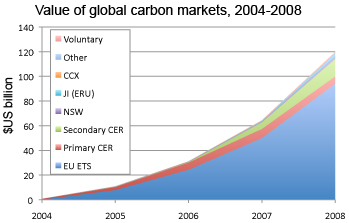

The value of the global carbon market surged 84 percent to $118 billion in 2008 despite the worldwide financial crisis, reports New Carbon Finance.

Data from the market research firm shows that transaction volume for carbon dioxide emissions allowances reached four billion tons for the year, an increase of 42 percent over 2007. The average price across all transactions rose to $29 per ton of CO2 from $23.

New Carbon Finance says it expects the market to reach $150 billion in 2009, despite falling carbon prices amid the global economic slowdown.

Chart showing growth in the global carbon market |

The European Union Allowance (EUA) market accounted for 70 percent of carbon emissions trading volume and 80% of value in 2008. The market share of Secondary Certified Emission Reductions (CERs) — credits sanctioned under the Clean Development Mechanism — reached 13 percent in 2008, up from 8 percent in 2007.

“Our analysis suggests a total market size of $150bn by year-end 2009,” writes New Carbon Finance. “This will be driven by moderate growth in the European allowance market (EUA), but most of the growth we expect to come from increased liquidity in the secondary CER market with more issuances and improved registries to transfer and hold these types of credits. The future of the CDM also looks more secure following the international negotiations in Poznan in December 2008 with firm commitments to improving the transparency and efficiency of the mechanism.”

The next round of climate talks in Copenhagen, Demark will weigh the inclusion of forestry offsets that could be generated through reforestation, avoided deforestation, and the reducing emissions emissions from deforestation and degradation (REDD) mechanism. Presently such credits are limited to voluntary markets, which grew to $499 million in 2008 from $265 million in 2007.