- Mongabay has begun publishing a new edition of the book, “A Perfect Storm in the Amazon,” in short installments and in three languages: Spanish, English and Portuguese.

- Mongabay has begun publishing a new edition of the book, “A Perfect Storm in the Amazon,” in short installments and in three languages: Spanish, English and Portuguese.

- Chronicling the efforts of nine Amazonian countries to curb deforestation, this edition provides an overview of the topics most relevant to the conservation of the region’s biodiversity, ecosystem services and Indigenous cultures, as well as a description of the conventional and sustainable development models that are vying for space within the regional economy.

- Click the “A Perfect Storm in the Amazon” link atop this page to see chapters 1-13 as they are published during 2023 and 2024.

Colombia

Colombia is Latin America’s largest producer of palm oil, with nearly 450,000 hectares (1.1 million acres) of oil palm plantations in 2020, with another 100,000 immature plantings that will expand production by about 20 per cent over the next few years. The sector generated approximately $US 5 billion in gross revenues in 2019 and contributes about 150,000 jobs to the national economy. Colombia has a relatively diversified producer sector, and most of the industrial producers actively support independent and smallholder producers. The sector is self-organized via the Federación Nacional de Cultivadores de Palma de Aceite (FEDEPALMA) and its highly competent research and extension service, Corporación Centro de Investigación en Palma de Aceite (CENIPALMA).

Smallholders represented a small minority of plantation area in Colombia until 2000, when the government initiated the Alianzas Productivas, an initiative that supports collaboration between smallholder associations and industrial-scale producers. When the programme started in 1999, there were an estimated 390 farmers with oil palm groves smaller than twenty hectares; by 2015, almost 55,000 smallholder families were participating in the initiative. This programme is expected to expand over the short term as part of Colombia’s efforts to provide economic opportunity to displaced people who reside, or once resided, in conflict areas.

There are four major oil palm regions in Colombia, and none of them are in the Amazon. Approximately fifty per cent of the nation’s plantations have been established on landscapes that were transformed by human activity long ago. Deforestation did lead directly to the establishment of about five per cent of the nation’s plantations on the Pacific Coast, while the conversion of natural savanna vegetation has preceded most plantations established on the Llanos de Orinoco.

The Llanos region is immediately adjacent to the Amazon watershed, and the savanna habitat located in that ecoregion is broadly comparable to the Cerrado biome of Central Brazil. Colombia’s palm oil sector promotes itself as ‘deforestation-free’; however, this claim ignores the land-use change and environmental degradation that accompanies expansion into the Llanos del Orinoco, which now accounts for about forty per cent of palm oil produced in Colombia.

Only one industrial-scale oil plantation is located within the Colombian Amazon; a single plantation in Caquetá (Human-Modified Landscape (HML) #52) has struggled to survive in a region better known for cattle and as a center of armed conflict and illicit drug production. Nonetheless, Caquetá and nearby landscapes in Putumayo (HML #51) and Guaviare (HML #54) have climates and landscapes appropriate for oil palm. In Caquetá alone, more than 1.2 million hectares (about 2.96 million acres) of degraded pasture provide a unique opportunity to expand palm oil production with net positive environmental and social outcomes.

Palm oil plantations established on degraded pastures sequester carbon and restore evapotranspiration functionality; they are also economically much more productive than cattle operations. Because relatively large landholdings exist in the region, they provide an opportunity for corporations seeking to establish new plantations. Investment in Caquetá has long been suppressed due to civil conflict, although the peace and reconciliation process provides an opening for expansion of the industry into the region.

Producers in high rainfall regions must deal with the constant threat from a serious plant disease, which affects plantations throughout South America. The disease has led to mass die-offs on large-scale oil palm plantations on the Pacific Coast in both Colombia and Ecuador, which demonstrates the very real risk of catastrophic failure inherent in any monoculture production system where the plants under cultivation are genetically identical.

Ecuador

Ecuador has one of the most egalitarian palm oil sectors in the world, with more than 85 per cent of all oil palm plantations owned by independent and smallholder producers. This trend will become even more accentuated in the future because smallholders have increased the area under cultivation over the past decade, while the area managed by corporate producers has shrunk due to disease infestations.

In 2020, there were about 6,800 oil palm farmers and about 50,000 jobs directly connected to the sector; an additional 100,000 indirectly benefit from palm oil production. One of the most unusual aspects of Ecuador’s palm oil sector is the diversity of its milling sector. Thirty independent mills are owned and operated by individuals who started as independent growers but have diversified their businesses by investing in medium-scale palm oil mills. Their combined milling capacity approximately equals that of the large corporations. Independent millers are, essentially, service providers to the independent growers and smallholder producers who dominate the sector in Ecuador.

Most of Ecuador’s 410,000 hectares (1.01 million acres) are located on the Pacific coastal lowlands, where transportation costs make producers more competitive in export markets and where banana growers have been diversifying their production systems. The Amazonian provinces of Sucumbíos and Orellana (HML #49) are important areas for palm oil production and plans for future expansion figure prominently in national development strategy documents.

There are currently about 18,500 hectares (45,714 acres) of corporate plantations operated by two companies that were established via the standard model of deforestation in the 1980s. In 2018, there was one independent palm oil mill that was building partnerships with smallholders. There are approximately 58,000 hectares (143,321 acres) of smallholder producers in Amazonian Ecuador; each farmer typically owns about 40 hectares (98.8 acres) and pursues a diversified production model that includes coffee, cacao, livestock and subsistence crops, as well as forest remnants and fallow lands.

These producers are increasingly adopting oil palm due to its overall profitability but also because of the economic stability it offers by producing throughout the year. In practical terms, this means farmers receive a check from the mill about every two weeks, which is a powerful incentive for a low-income family.

Peru

The first oil palm plantations in Peru were established in the 1970s by a state-owned palm oil company near the village of Tocache in the Upper Huallaga Valley in the Department of San Martin (HML #42); similar facilities were soon established near Pucallpa in Ucayali Province (HML #41) and between Tarapoto and Yurimaguas in the Lower Huallaga Valley (HML #43). Economic mismanagement combined with civil unrest eventually pushed these enterprises into bankruptcy; nonetheless, they left a legacy of oil palm plantations and mill infrastructure that are important parts of Peru’s current palm oil supply chain.

Each of these production landscapes is now home to farmer-owned companies whose shareholders received their equity stake as severance pay when the state-owned company declared bankruptcy in the mid-1980s. Growth in the smallholder sector stagnated between 1990 and 2010, despite investments by international development agencies who viewed it as a viable alternative to illicit crops.

A biofuel policy promulgated by the government in 2008 instigated a new phase in the palm oil sector in Peru. The policy motivated growers to expand production, as well as attract new farmers and investors to adopt the palm oil production system. Medium-scale independent growers, previously nonexistent, have established a presence on landscapes dominated by smallholders. As in Ecuador and Colombia, some of these middle-class producers are successful smallholders who have scaled-up production by purchasing more land; others are urban investors seeking a profitable long-term investment.

In 2017, the members of grower associations linked to grower-owned companies operated about 33,000 hectares (81,544 acres) and provided about forty per cent of the country’s palm oil supply. At approximately the same time the state was introducing oil palm in Tocache, one of the country’s largest private corporations, Grupo Romero, established a plantation and mill complex in Tocache. That enterprise also suffered from the economic and civil unrest of the 1980s and 1990s, but its owners persevered and are now Peru’s largest producer of palm oil via its subsidiary corporation Grupo Palmas.

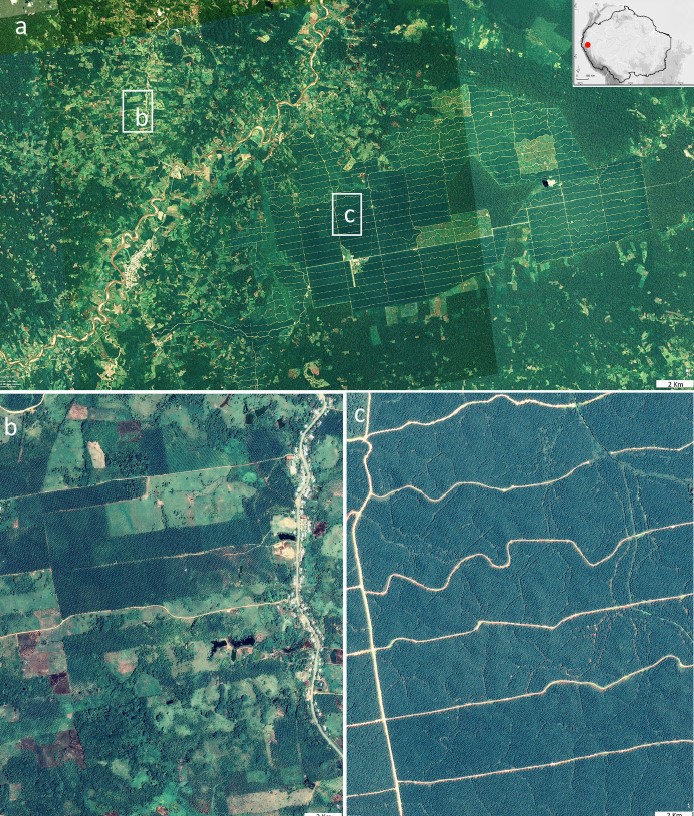

This family-owned enterprise operates two industrial-scale oil palm plantations and associated industrial-scale processing facilities: Palmas de Espino in Tocache with about 12,000 hectares (29,652 acres) and Palmas de Shanusi, which has approximately 10,000 hectares (24,710 acres) located between Tarapoto and the Amazonian port city of Yurimaguas (HML #44).

Originally, almost a hundred per cent of the original smallholder plantations were established via the direct clearing of primary forest during the 1980s and 90s; subsequently, they expanded via the conversion of pasture, idle cropland and secondary forest, as well as by clearing remnant natural forest patches. The vast majority of the Grupo Palmas’ 23,000 hectares (56,834 acres) of plantations have been established via the direct clearing of primary natural forest. Approximately 9,000 hectares (22,239 acres) were established in the 1980s and 1990s at Tocache.

More recently, direct forest clearing also preceded the establishment Palmas de Shanusi between 2005 and 2013. This last expansion generated considerable controversy and was challenged in court by environmental advocates. The company prevailed through the regulatory process, however, because they processed their permits via the Ministry of Agriculture and its land-use planning law, which the court determined had precedence over the guidelines established by the Ministry of the Environment.

There is a fourth major player in Peru’s palm oil industry, known as the Grupo Melka, a corporate entity that represents (or represented) a group of investors with connections to Southeast Asia. This company attempted to establish two oil palm plantations in Coronel Portillo Province of Ucayali Region in 2013. In contrast to the Grupo Romero, these investors have had less success using the legal and regulatory processes in Peru to legitimize their plantations and in 2017 abandoned their investment.

The failure of the Grupo Melka represents a significant financial loss to its investors and may signal the end of attempts to create industrial-scale oil palm plantations at the expense of the forest estate in Amazonian Peru. The Grupo Palmas essentially ratified this new reality when it publicly embraced a no-deforestation policy in April of 2017. Presumably, the company adopted the zero-deforestation policy based on its evaluation of the business risk associated with deforestation and a desire to increase exports to North American and European markets.

Brazil

The first cultivation of oil palm outside of Africa occurred in Bahía, where it was introduced as a food crop more than 400 years ago. Currently, there are about 54,000 hectares (133,436 acres) of oil palm groves scattered across the coastal municipalities of Bahía where they are cultivated on plots that are seldom larger than ten hectares. These producers supply most of the national consumption of dendé, which is the name for the crude red palm oil that is an ingredient in many traditional Brazilian recipes. Industrial-scale palm oil is concentrated in the Amazonian state of Pará, where a modern palm oil industry was created in the 1970s in response to Brazil’s geopolitical strategy to populate and develop the Amazon. Production in Pará grew steadily over the next three decades, averaging about three per cent growth per year until 2007. Over the last ten years, however, the area under cultivation grew rapidly rising from about 55,000 hectares (135,907 acres) in 2010 to more than 165,000 hectares (407,723 acres) in 2019.

Like other oil palm landscapes in South America, Pará has a combination of large, medium and small-scale farmers; however, large-scale producers dominate the sector and can be stratified into three subcategories: large (2,000–4,000 ha; ), very large (5,000–10,000 ha) and massive (> 35,000 ha). Of the three massive producers, Agropalma is a long-established company that has grown organically since its founding in the 1980s. The other two, Belem Bioenergía Brasil and Biopalma da Amazônia were established in 2011 by two of Brazil’s largest corporations (Petrobras and Vale) when the government was promoting biofuel as a component in its national energy and rural development strategies.

Agronomics and logistics plagued both operations and neither company started to produce significant volumes of palm until 2018; moreover, the economics of biofuels were undermined by price declines in the fossil-fuel market after 2015. Both parent companies divested their interests in 2019 and 2020 at a loss estimated at more than R$ 1 billion ($203.4 million) each. Both plantations were acquired by Brasil Biofuels, a start-up company cultivating oil palm as a biodiesel supplement for thermal generation plants in Roraima, Acre and Rondônia and Amazonas. They are currently the largest oil palm producer in Latin America, with more than 63,000 hectares (155,676 acres) that supply vegetable oil to power plants in municipalities that are physically isolated from Brazil’s integrated energy grid.

Brazil’s palm oil corporations have pursued a strategy of sourcing oil palm fruits from smallholders and independent producers, an effort that has been proactively supported by the Brazilian government via two programmes: Programa Nacional de Fortalecimento da Agricultura Familiar (PRONAF) a nationwide programme that provides technical assistance and concessionary loans to small farmers, and the Produção Sustentável de Óleo de Palma (PSOP), which has provided tax incentives to companies and concessionary loans to small and medium-scale farmers since 2010.

In spite of these programmes, efforts to expand smallholder production have faced many challenges; most are related to a general lack of technical capacity and the multiple problems linked to making credit available to small farmers.

Prior to 2000, almost all expansion occurred via forest clearing; however, all the producers in Pará have halted these practices and embraced a zero-deforestation policy. Agropalma has reported that 45 per cent of its total plantation area was established via forest clearing. The change in practices stems, in part, from regulatory rules to ensure that palm oil production for biofuel avoids deforestation, but also because Brazilian producers seek to compete in overseas markets by providing certified, identity-preserved, deforestation-free palm oil.

“A Perfect Storm in the Amazon” is a book by Timothy Killeen and contains the author’s viewpoints and analysis. The second edition was published by The White Horse in 2021, under the terms of a Creative Commons license (CC BY 4.0 license).

Read the other excerpted portions of chapter 3 here:

Chapter 3. Agriculture: Profitability determines land use

-

- Agriculture: profitability determines land use October 10, 2023

- Agriculture in the Pan Amazon: Beef production models October 11, 2023

- Industrial infrastructure in the Pan Amazon October 17, 2023

- National versus global markets – beef in the Brazilian Amazon October 19, 2023

- Livestock farming in the Andean Amazon and the rest of the Amazon October 24, 2023

- Intensive agriculture in the Pan Amazon: Soy, maize and other field crops October 25, 2023

- Agriculture in the Pan Amazon: Global markets for soybean and corn crops October 31, 2023

- Agriculture in the Pan Amazon: Industrial infrastructure for grains and cereals November 1, 2023

- Agriculture in the Pan-Amazon: Swine and poultry – Adding value to farm production November 8, 2023

- Oil palm in the Pan Amazon November 9, 2023

- Palm oil cultivation in Colombia, Ecuador, Peru and Brazil November 13, 2023

- What does oil palm require to reach international markets? November 14, 2023

- Biofuels in the Pan Amazon November 21, 2023

- Coffee and cacao in the Pan Amazon November 22, 2023

- Cultivation and processing of Amazonian coffees November 28, 2023

- High quality cacao in Amazonia November 29, 2023

- Local and national food crops in the Andean Amazon December 5, 2023

- Coca in the Amazon – The anti-development crop December 6, 2023