- Nearly 130 nations last week agreed to “halt and reverse forest loss and land degradation” by 2030. Accompanying that declaration was a commitment to allocate $19.2 billion toward that goal. But how will these resources be deployed in the Amazon?

- Some of that money is expected to go toward reforming the production systems that drive deforestation. That money would likely matched by even larger amounts of private capital in search of so-called “green investments.” How that money is channeled and who benefits will determine whether Amazonian societies address the long-standing social inequality that is also a key driver of deforestation.

- In “A Perfect Storm in the Amazon Wilderness”, Tim Killeen provides an overview of rural finance with a special focus on mechanisms designed to support smallholders. Killeen also takes a critical look at the emerging market for “green bonds”

- This post is an except from a book. The views expressed are those of the author, not necessarily Mongabay.

Editor’s note: Tim Killeen provides an update on the state of the Amazon in his new book “A Perfect Storm in the Amazon Wilderness – Success and Failure in the Fight to save an Ecosystem of Critical Importance to the Planet.”

The book provides an overview of the topics most relevant to the conservation of the Amazon’s biodiversity, ecosystem services and Indigenous cultures, as well as a description of the conventional and sustainable development models vying for space within the regional economy.

The narrative explains the social and economic realities that constrain the decisions of stakeholder groups and economic actors and motivates them to act as they do. It also identifies the policies that have created a foundation for change in the region, as well as those that are not delivering the benefits their advocates had hoped to generate.

Mongabay will publish excerpts from the Killeen’s book, which will be released by The White Horse Press in serial format over the course of the next year (Killeen is also working to adapt the book into Spanish and Portuguese). In this third installment, we provide a section from Chapter three: Agriculture: Profitability determines land use. You can read the first at The political economy of the Pan-Amazon and second at New transport infrastructure is opening the Amazon to global commerce. Killeen has a GoFundMe campaign here.

Nearly 130 nations last week agreed to “halt and reverse forest loss and land degradation” by 2030. Accompanying that declaration was a commitment to allocate $19.2 billion toward that goal. But how will these resources be deployed in the Amazon?

If the messaging in the declaration is to believed, a portion of that money will go toward Indigenous peoples’ and local communities’ efforts to steward their lands. But some of that money is expected to go toward reforming the production systems that drive deforestation. That money would likely matched by even larger amounts of private capital in search of so-called “green investments.” How that money is channeled and who benefits will determine whether Amazonian societies address the long-standing social inequality that is also a key driver of deforestation.

Every country in the Pan Amazon has a system for channeling financial resources to producers in the rural economy, with different mechanisms for corporations, communities and families. Some are well designed. Some not so much. Policy makers need to understand what exists before they start throwing money at complex systems characterized by inequality and a deeply ingrained aversion to risk.

Rural finance in the Amazon

The agricultural producers of the Amazon have access to radically different levels of credit depending upon national policies, the willingness of each country’s financial services industry to engage rural populations and, most importantly, the scale of their production system. Brazil has the most sophisticated agricultural sector and, not surprisingly, the most generous and far-reaching system to support its producers. Industrial-scale farmers have access to multiple forms of credit, which they access to pay operational costs, acquire technology and invest in on-farm infrastructure. If they are entrepreneurial, and many are, they borrow money to acquire land and expand production. Small family farms have fewer options, but the federal government has programs to provide them with affordable short-term credit. Regardless, the cash economy predominates on forest frontiers and within smallholder landscapes where producers must overcome barriers imposed by physical isolation and subsistence livelihoods. Financial credit to support production is largely absent in the Andean Amazon, where small farmers operate within an informal economy with limited access to financial services.

Brazil’s financial system operates on two tracks: the Sistema Nacional de Crédito Rural (SNCR), which is managed by the financial industry according to rules established by the federal government; and an independent system managed by multinational trading companies designed to capture commodities for their competing supply chains. The latter includes the four well-known western giants: ADM, Cargill, Bunge and Louis Dreyfus, as well as second-tier companies based in Brazil (Amaggi), Japan (Gavilon), Europe (Sodrugestvo) and China (COFCO). Within the Amazon, the SNCR provides most of the credit used by the livestock sector, while the region’s grain farmers depend upon credit obtained from the SNCR, loans from commercial banks and, most importantly, short-term credit provided by commodity traders.

The SNCR was established in 1965 in conjunction with government policies to promote settlement and investment in the agricultural frontiers of the Southern Amazon. Its main objective is to provide producers with working capital at below-market interest rates so they can plant and harvest a crop or raise a herd of cattle for slaughter. The national rural finance plan (Plano Safra) of 2020/2021 provided $R 236 billion (~$45 billion) in loans to the livestock, farm and plantation sectors; 75% was used for short-term credit, and 25% was allocated for medium to long-term investments. Small producers had access to R$ 33 billion with interest between 2.75% and 4%, while medium-sized producers received a similar sum at 5%. Large-scale producers, who receive the bulk of the finance, were charged between 6 and 7% annual interest. [i]

The SNCR program has been, and remains, an important element in national development strategies and has catalyzed the impressive growth of Brazilian agriculture. The success of the SNCR rests on its ability to leverage the domestic savings of the Brazilian people with the technical capacity of Brazil’s commercial banking sector. Its genius was to provide low-cost credit to strategically important producers in an economy characterized by high interest rates. The lion’s share of the SNCR’s financial resources is generated by a regulatory requirement that obligates commercial and savings banks to either: (a) transfer 34 per cent of their deposits to the Banco Central do Brasil or (b) use those resources to fund loan portfolios in agriculture and forestry. [ii] Attractive interest rates are a magnet for investors, especially when combined with an easily understood business model based on conventional economics. Brazil’s abundant soil and water resources are the foundation of its rural economy, but the SNCR shares much of the credit for creating an agricultural powerhouse. It also shares responsibility for the conversion of approximately eighty million hectares of Amazonian rainforest and an approximately equivalent area of Cerrado savannas. [iii]

The SNCR channeled hundreds of millions of dollars into the Southern Amazon during the 1970s to establish a cattle industry on land being distributed to influential families and corporations. [iv] In the 1980s, the program loaned money during a period of hyperinflation at interest rates well below the rate of inflation, an untenable situation that led to its near-collapse in the early 1990s. The SNCR was revitalized following the stabilization of the Brazilian economy in the administration Fernando Henrique Cardoso, who introduced two additional programs managed by the national development bank: PRONAF, which is targeted at smallholders, and PRONAMP, which provides finance to medium-scale producers. Regional development banks, known as Fundos Constitucionais de Financiamento, also have credit programs targeted at their rural constituents. [v]

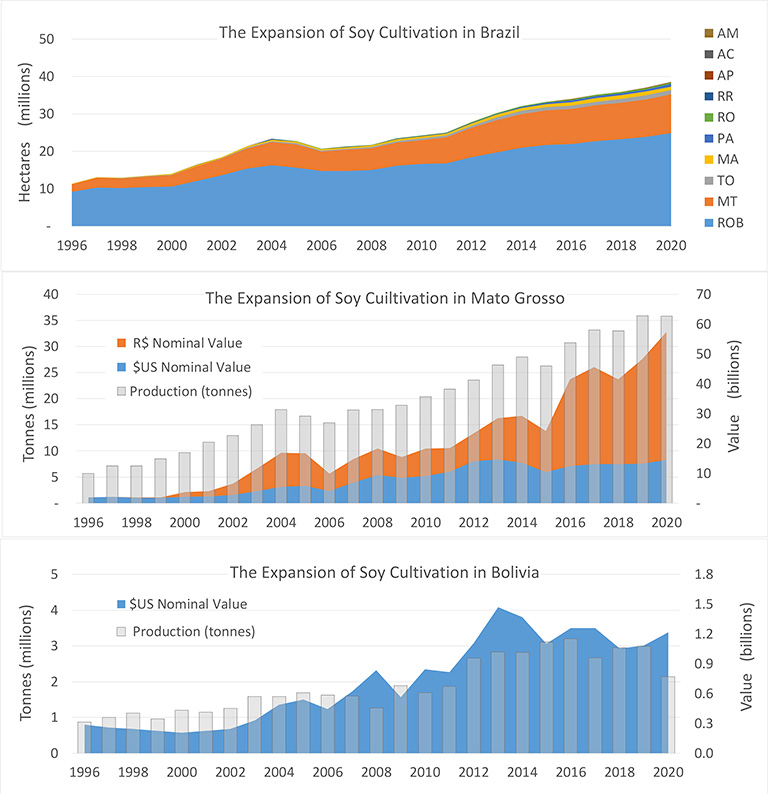

A recent review revealed that between $9 and 12 billion dollars were loaned annually via the SNCR to Amazonian producers during the last decade. Of this amount, approximately 44% went to Mato Grosso, followed by Tocantins (18%), Pará (13%), Maranhão (13%), and Rondônia (9%). [vi] This study looked only at four commodities considered to be the main drivers of deforestation and reported that 64% of the loans went to cattle ranchers and 35% to soy farmers, with smaller amounts to timber (0.5%) and oil palm plantations (0.7%). Data for PRONAF were reported only at the national level, but small farmers cultivating soy, beef and palm oil received only two percent of the resources channeled via the SNCR.

The contribution of the trading companies is difficult to know because they do not break out those numbers in their annual reports. They can be estimated, however, using bottom-up methods and government reported statistics. In the 2019/2020 crop-year, soy and maize were cultivated on approximately eighteen million hectares in the states of the Legal Amazon, where the leading extension agency reported the cost of seed, fuel, agrochemicals and labour at $650 per hectare. [vii] Assuming that a hundred per cent of crop is planted and harvested using short-term credit, then agribusiness would need approximately $13 billion to plant and harvest a crop. Since only $1.6 billion was obtained via the SNCR, [viii] the remaining $11.4 billion was probably supplied by the commodity trading companies. That may be an overestimate, however, because large-scale producers, who control approximately 46 per cent of the agricultural land in Brazil, are often subsidiaries of diversified corporations. As such, they have access to multiple forms of credit, including domestic bond markets and overseas private equity. [ix]

Bond markets include corporate bonds, which are ‘debentures’ backed by the reputation of the company and Certificados de Recebíveis do Agronegócio (CRA); these are securities that place a lien on a physical or contractual asset. Both are used by agribusinesses and banks to finance medium to long-term investments (two to twelve years). If the CRA is issued by a bank, it is likely to be a basket of loans to family farmers, while corporations use them to fund individual projects or activities. The Brazilian bond market has attracted international attention over the last several years (post-2015) because it is viewed as a venue for sustainable finance that seeks to minimise risk from ‘environmental, social and governance’ (ESG) factors that harm society and, presumably, increase the risk of losing money.

The most common types, and the largest by volume ($10 billion) have been ‘green bonds’ issued by corporations accessing capital markets without the intermediation of banks. In the Amazon, companies are committing to consume (self-generated) renewable energy, increase productivity, sequester soil carbon and, allegedly, conserve biodiversity and water resources. One of the largest initiatives is FS Bioenergia ($639 million) a maize-based ethanol producer that is a joint venture between the Iowa-based Summit Holdings and a Tapajos Participaes S/A, a Brazilian subsidiary of a Chinese holding company (Hunan Dakang). Brazilian agribusiness giants are likewise accessing the green bond market, including SLC Agrícola ($480 million) that farms 150,000 hectares in Mato Grosso and Maranhão; and Amaggi S/A ($750 million), which operates an integrated supply chain spanning 259,000 hectares in Mato Grosso and includes logistics and processing facilities in Rondônia, Amazonas and Pará. [x]

One of the most controversial offerings, is a ‘transitional loan’ to Marfrig Alimentos S/A ($430 billion), a beef packing company committed to eliminating illegal deforestation and unfair labour practices from its supply chain. The tender is classified as a loan rather than a bond due to the contractual terms of the offering; it is controversial because most of the resources will be used to support their dedicated supply chain (Marfrig Club) without adequate guarantees to reform or exclude calves originating from independent producers who are not in compliance with the Forest Code. [xi] The criteria for evaluating the ESG performance will rely on Key Performance Indicators (KPIs) specified in the prospectus of individual that are validated by independent third party review.

There is only limited potential for finance to change agricultural practices in the Andean Amazon, because landscapes are largely populated by smallholders who are notoriously risk-adverse in how they manage their finances and cropping systems. They are cautious because the consequences of a crop failure are catastrophic for their families; consequently, they are less likely to adopt novel production systems that require a capital investment that would have to be financed by debt. Nearly all understand the value of credit and its potential to transform their lives; however, the options available to them are neither friendly nor fair. [xii]

Andean governments have launched multiple efforts over several decades trying to create mechanisms and institutions to provide financial credit for rural communities, but they have failed to change the calculus that impedes investment on smallholder landscapes. One manifestation of the challenge is the high proportion of families that are unbanked, a term economists use to describe individuals who, by choice or circumstance, do not use financial services. Another is the role of microfinance institutions that provide credit to individuals who do not qualify for loans from conventional banks; instead, they borrow money based on ‘good faith’ and reputational integrity. Their presence has materially benefitted the lives of tens of thousands of individuals, many of them women, by allowing them to participate in the informal market economy that characterizes commerce in these nations. In addition, they offer savings accounts and provide families with a digital identity for interacting with government agencies and utility companies. Unfortunately, these institutions lend money at interest rates that are out of reach for small farmers.

The microfinance business model was born in the marginalized neighborhoods of major cities, but these institutions are now present in most mid-sized cities where they also cater to the needs of surrounding rural communities. Interest rates, which range from twenty to eighty per cent, reflect the risk of default associated with their clientele and the high transaction costs associated with administering tens of thousands of small loans [xiii] Most microfinance entities operate with capital obtained from conventional banks and investment funds and pay those institutions standard commercial interest rates (five to eight per cent). Microfinance, which is marketed as a pro-poor public service, is also a highly lucrative business model. [xiv]

Presumably, a farmer would be a low-risk debtor when compared to an individual engaged in speculative commerce, but the financial sector considers small family farms as high-risk creditors due to weather and pests. In Peru, inflation-adjusted interest rates for small farmers are between twenty and thirty per cent, a value that is out of reach for all agricultural production systems, much less smallholders living on the edge of poverty. Large- and medium-scale producers have access to conventional forms of credit because they can meet the conditions required by lending agencies, particularly legal title to their land and a documented history of production and sales. Even these numbers are disappointing, however. In 2019, government agencies reported that $33 million were loaned to 4,199 beneficiaries in a country with an estimated 2.2 million farmers. [xv]

Peru has attempted various models to channel funds via savings and loan cooperatives (COOPACS), privately-owned rural savings banks (Caja Rurales), mixed associations of private capital and local government (Caja Munciaples) and a specialized state-owned development bank (Agrobank). None have succeeded in providing affordable credit to small farmers. The most recent attempt, a special fund (FAE-Agro) that is capitalized by the national development bank (COFIDES) is doomed to failure because recipients are required to show legal title for their properties, a condition enjoyed by only fifteen per cent of the small farmers of Peru (see Chapter 4). [xvi]

Civil society has had better success working with grower’s associations that simultaneously provide technical support in agronomics, pest management and business administration for individual growers and their umbrella organizations. Successful initiatives are characterized by a long-term commitment on the part of civil society organizations and specialty buyers willing to invest in programs that guarantee a supply of coffee and cacao that is certified as deforestation-free, organic, indigenous and/or gender positive.

Bolivia’s agricultural sector is similar to Brazil’s but also quite different. There is a limited number of large-scale producers, quite a few (upper) middle-class landowners and a large, dynamic small-farm constituency. It lacks, however, a state sponsored rural credit program that obligates the financial industry to channel money to its producers. Large and mid-scale farmers access capital via the commodity trading companies, as well as from an informal credit market best described as a normalized system of loan sharks. Ranchers rely on family capital, personal savings or cash flow generated by urban business ventures (medical services, real estate, commerce).

The smallholders of Bolivia are also active participants in the national foodstuffs market, and quite a few have evolved into successful soybean farmers. Many are descendants of Andean indigenous migrants with a strong cultural tradition of savings and investment, traits shared by a large Mennonite community. These groups also have an informal credit market they use for short-term finance. Microfinance institutions are present and, as in Peru, they have opened offices in regional cities. Government policies to distribute cash income to elderly and school-age children have motivated hundreds of thousands of rural families to open savings accounts. High interest rates, however, preclude their ability to borrow money to invest in agricultural technology.

Ecuador’s microfinance industry is dominated by savings and loan associations that serve both urban and rural populations; interest rates range between 25 and 28 per cent. The traditional banking system treats agricultural credit as one of several types of ‘productive enterprise’, all of which have annual interest rates between eight and twelve per cent. [xvii] The government hopes to support its agricultural sector via a newly constituted public bank, BanEcuador, which offers loans specifically designed for, and marketed to, producers of coffee, cacao and oil palm. Producers can borrow up to $150,000 for both short-term credit and to improve productive capacity (plantations); for the latter, terms of up to fifteen years are available, with a grace period of between three to five years. [xviii] Loans greater than $20,000 require a mortgage guarantee.

The BanEcuador programs show an understanding of the needs of their potential clientele, including payment schedules based on the cash flow of individual production strategies (monthly, quarterly, or annually). Annual interest rates range between 9.75 and 16.5 per cent, in line with business loans from private banks and significantly lower than those available from microfinance institutions. Regardless, interest rates at this level are not likely to catalyze a wave of much-needed investment in agricultural production. In 2019, BanEcuador loaned $3 million to 700 producers, a relatively small amount that would translate into only about 500 hectares of new oil palm plantations.

Colombia has a program similar to the SNCR of Brazil. It is administered by FINAGRO (Fondo Para el Financiamiento del Sector Agropecuario), a public agency that operates as a second-tier lender to private institutions and a guarantor for a variety of financial products, including short and long-term credit and crop insurance. The FINAGRO system establishes standard terms and rates for a diversified portfolio of credit products specifically designed for the needs of producers in agriculture, livestock and plantation forestry. Programs span the landholder spectrum and include special initiatives for producer associations. Interest rates range from three to ten per cent above a base rate set by the central bank, which has fluctuated between three and five per cent since 2010 . FINAGRO also offers discounts to the intermediary institution to make the loan more accessible to the retail client. [xix] For a commission, FINAGRO will guarantee the loan for the producer, which is essentially a form of crop insurance; it also offers conventional crop insurance to protect the producer and the lending agency from climate risk and pests.

At the national scale, FINAGRO facilitated financial credit worth approximately $7.1 billion in 2020, up from $2.9 billion in 2011, increasing by an impressive twenty per cent annually over the same period. Although the Colombian program is well designed and considers both market reality and the special needs of producers, it operates only on landscapes where the state has imposed the rule of law. Unfortunately, Amazonian landscapes are characterized by the absence of the state, either because they are remote or because they are under the control of armed criminals. In Amazonian departments, FINAGRO facilitated only about $80 million in 2020, a number that has remained essentially flat since 2010. [xx] Approximately half of that was in Caquetá and, presumably, was lent to the cattle sector, which is also the largest single recipient of agricultural credit within the FINAGRO system.

Harnessing Finance to Change Behavior

Rural finance has enormous potential to reform conventional agricultural production systems. Consequently, it is a common component of policy proposals to combat deforestation where it is viewed as a ‘carrot’ to accompany the ‘sticks’ that seek to coerce landholders to reform land use practices (see Chapter 7).

The experience of the Cattle Agreement and the Soy Moratorium show the potential when commercial intermediaries are used as pressure points to eliminate illegal deforestation. These initiatives, which focus on excluding transgressors from supply chains, could be expanded by conditioning access to the billions of dollars of short-term loans provided annually by international commodity traders and meat packing companies. As a driver of sustainability, credit might be even more effective if these same companies offered long-term loans with concessionary rates that motivated their suppliers to restore forest that had been converted illegally in the recent past.

Similar changes to the Sistem Nacional de Credito Rural (SNRC) could likewise catalyze widespread change, particularly within the Brazilian cattle industry where decades of over grazing have degraded millions of hectares of pasture. Pasture restoration begins and ends with soil conservation, which relies on management practices to increase soil organic matter and, in the process, create a long-term carbon sink (see Chapter 4). This is essentially the goal of Brazil’s Agricultura de Baixo Carbono (ABC) program, a subcomponent of the SNCR with attractive interest rates and an extended pay-back period. [xxi] Supported technologies include reduced tillage, pasture renovation, integrated crop and livestock management, and the restoration of riparian habitat (see Chapters 4 and Chapter 6). The ABC program has enjoyed modest success – in 2020, the program lent approximately $R 2 billion ($400 million) – nonetheless, that is less than one per cent of the total channeled through the SNCR in 2020. The potential, given Brazil’s history of using the SNCR to subsidize its agricultural producers, is massive and eminently practical.

Green bonds and similar types of ESG finance are the fastest growing component of Brazil’s financial sector. International capital markets are frenetically seeking viable projects to satisfy massive global demand for ESG investment. Brazil’s potential to satisfy this demand by reducing GHG emissions caused by deforestation can be leveraged by an equally massive capacity to sequester carbon via economically advantageous technologies to make conventional agriculture more sustainable. This type of risk-limited green investment will be a magnet for global investors. The country’s attractiveness is reinforced by the nation’s cultural commitment to a market economy, its openness to international capital and the abundant natural resources that are the foundation of its rural economy.

The performance of green bonds in Brazil is being closely watched by policy analysts, because of their potential to drive climate change action ‘at scale’. Nonetheless, these instruments, and others like them, risk being labeled as ‘greenwash’ if they succeed in improving the performance of participating companies but fail to resolve the deforestation crisis. That outcome will depend, in large part, on the ability of the Brazilian state – and its private sector partners – to incorporate smallholders in a revitalized and reformed rural economy. Brazil has created the institutional mechanisms for pursuing that goal (INCRA, EMBRAPA, PRONAF, SNCR), but its track record for dealing equitably with its own citizens is not particularly encouraging.

In the Andes Amazon, the potential to link finance, including short and long-term credit, with effective policies to transform their agricultural sector is even more challenging. No nation has succeeded in delivering affordable credit to their Amazonian populations, nor develop an extension system capable of ensuring those resources are invested in productive enterprises that are globally competitive and environmentally sustainable. If they have any advantage, compared to Brazil, it is the preponderance of smallholder systems that creates a precondition that favours social equity. That advantage, however, is a double-edged sword. It may ensure that a reformed system will be socially sustainable, but it also makes it enormously more difficult to implement.

If the Amazon forest is to be saved, deforestation must end. Full stop. Global and national markets, however, will continue to demand more commodities from the farmers and ranchers of the Southern Amazon and Andean Piedmont. They will respond by increasing production. Full stop. They could intensify their systems by investing in technology, or they could purchase more land to expand production. Left to their own devices, they would pursue both options because that is the logical pathway to maximize the return on their investments. Farmers and ranchers do not operate in a vacuum, however. Producers, large and small, allocate their resources in response to regulatory and market forces that govern the agricultural economy. Among the most important are the constraints and incentives in rural real estate markets (see Chapter 4). When the forest frontier ceases to be a source of inexpensive land, the agricultural sector will be forced to invest in the land under production — and only the land under production. Making that happen sooner, rather than later, is essential for saving the Amazon.

[i] MAPA – Ministério da Agricultura, Pecuária e Abastecimento. 2020. Política Agrícola, Plano Safra 2020/2021 entra em vigor nesta quarta-feira Plano Dafra: https://www.gov.br/agricultura/pt-br/assuntos/noticias/plano-safra-2020-2021-entra-em-vigor-nesta-quarta-feira

[ii] Ibid.

[iii] Strassburg, B.B., T. Brooks, R. Feltran-Barbieri, A. Iribarrem, R. Crouzeilles, R. Loyola… and A. Balmford. 2017. ‘Moment of truth for the Cerrado hotspot’. Nature Ecology & Evolution 1 (4): 1–3.

[iv] Yuri Ramos, S. and G. Bueno Martha Jr. 2010. Evoluçcão da Politica de Créditop Rural Brasileria, EMBRAPA Cerrado, Brasilia.

[v] Souza, P., S. Herschmann and J. Assunção. 2020. Política de Crédito Rural no Brasil: Agropecuária, Proteção Ambiental e Desenvolvimento Econômico. Climate Policy Initiative, Rio de Janeiro: https://www.climatepolicyinitiative.org/pt-br/publication/politica-de-credito-rural-no-brasil-agropecuaria-protecao-ambiental-e-desenvolvimento-economico/

[vi] Forests & Finance Coalition. 2021. Finance data, Explore the data: https://forestsandfinance.org/data/

[vii] IMEA – Instituto Mato-Grossense de Economia Agropecuária. 2021. CUSTO DE PRODUÇÃO, DSoja GMO: https://www.imea.com.br/imea-site/relatorios-mercado-detalhe?c=4&s=3

[viii] Forests & Finance Coalition, Finance data.

[ix] OXFAM – BRASIL. 2016. Terrenos da Desigualdade: https://www. oxfam. org. br/publicacoes/terrenos-da-desigualdade-terra-agricultura-e-desigualdade-no-brasil-rural

[x] Climate Bond Initiatives. 2021. https://www.climatebonds.net/files/reports/cbi-brazil-agri-sotm-eng.pdf

[xi] FAIRR Farm Animal Investment Risk and Return Initiative (2019) https://www.fairr.org/article/marfrigs-transition-bond

[xii] Pinzon, A. 2019. Redefining finance for agriculture: Green agricultural credit for smallholders in Peru. Global Canopy: https://www.meda.org/innovate/innovate-resources/822-partner-publication-redefining-finance-for-agriculture-green-agricultural-credit-for-smallholders-in-peru-eng/file/

[xiii] SBS – Superintendencia de Banca, Seguros y AFP. 2021. Tasa de interés promedio del sistema de cajas rurales de ahorro y crédito: https://www.sbs.gob.pe/app/pp/EstadisticasSAEEPortal/Paginas/TIActivaTipoCreditoEmpresa.aspx?tip=C

[xiv] Sengupta, R. and C.P. Aubuchon. 2008. ‘The microfinance revolution: An overview’. Federal Reserve Bank of St. Louis Review 90 (Jan./Feb.)

[xv] Gestión. 26 Nov. 2020. El FAE-AGRO Es Un Completo Fracaso, Grupo Propuesta Ciudadana: https://gestion.pe/blog/propuesta-ciudadana/2020/11/el-fae-agro-es-un-completo-fracaso.html/?ref=gesr

[xvi] Ibid.

[xvii] ASOBANCO – Asociación de Bancos del Ecuador. 2019. Informe Técnico: Tasas de Interés, Volumen N°1: https://www.asobanca.org.ec/file/2286/download?token=IHmybA6t

[xviii] BanEcuador. 29 May 2021. Credito Productivo Palma, Microempresas: https://www.banecuador.fin.ec/productos-ciudadanos/credito-micro/productos-microempresas/credito-palma/

[xix] FINAGRO – Fondo para el Financiamiento del Sector Agropecuario. 2 June 2021. Productos y Servicios, Portfolio de Servicios: https://www.finagro.com.co/productos-y-servicios

[xx] FINAGRO – Fondo para el Financiamiento del Sector Agropecuario. 2 June 2021. Estadísticas: https://www.finagro.com.co/estad%C3%ADsticas

[xxi] Banco do Brasil (26 July 2021) Agricultura de Baixo Carbono (ABC), https://www.bb.com.br/pbb/pagina-inicial/agronegocios/agronegocio—produtos-e-servicos/credito/investir-em-sua-atividade/agricultura-de-baixo-carbono-(abc)