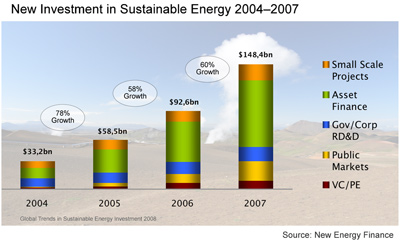

Clean energy investments rose 60% to $148 billion in 2007

Clean energy gold rush in 2007

mongabay.com

July 1, 2008

New investment in renewables and energy efficiency surpassed $148 billion in 2007, rising 60 percent rise from 2006, according to an analysis issued Tuesday July 1 by the UN Environment Programme (UNEP). High oil prices drove the trend.

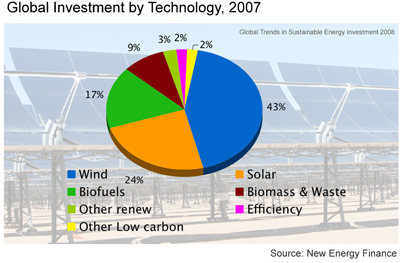

“Global Trends in Sustainable Energy Investment 2008” reports that wind energy saw the most investment ($50.2 billion in 2007), but solar power grew most rapidly, attracting some $28.6 billion of new capital and growing at an average annual rate of 254% since 2004.

Europe saw the largest investment flows, followed by the United States. China, India and Brazil saw growing investor interest, their share of new investment growing from 12% in 2004 ($1.8 billion) to 22% in 2007 ($26 billion).

For the year the total value of renewable energy transactions was $204.9 billion, of which $98.2 billion went into new renewable energy generation, $50.1 billion went into technology development and manufacturing scale-up, and $56.6 billion was exchanged through mergers and acquisitions. Sustainable energy companies accounted for 19% of all new capital raised by the energy sector in global stock markets for the year.

|

The 31 gigawatts of newly installed generation from renewable sources accounted for 23% of new power capacity added globally in 2007, roughly 10 times that of nuclear.

The report predicts that renewable energy investment will reach $450 billion a year by 2012 and more than $600 billion a year by 2020.

“2007 was a banner year for the clean energy industry. Wind continued its strong progress, with installed capacity passing the 100 GW mark,” said Michael Liebreich, CEO of New Energy Finance Ltd and co-author of the report. “Solar is maturing rapidly, with heavy investment to ease the silicon bottleneck and new thin-film technology beginning to reach scale. And there are plenty of other technologies lining up to be the next ones to begin a real march to scale — including biomass and geothermal. Carbon Capture and Storage (CCS) is the only sector where we did not see as much progress as we had expected, with the regulatory and funding environments for these projects remaining murky and timelines for the first commercial projects being extended.”

“The clean energy industry is maturing and its backers remain bullish,” said Achim Steiner, the head of UNEP. “Just as thousands were drawn to California and the Klondike in the late 1800s, the green energy gold rush is attracting legions of modern day prospectors in all parts of the globe.”

“A century later, the key difference is that a higher proportion of those looking for riches today may find them. With world temperatures and fossil fuel prices climbing higher, it is increasingly obvious to the public and investors alike that the transition to a low-carbon society is both a global imperative and an inevitability. This is attracting an enormous inflow of capital, talent and technology. But it is only inevitable if creative market mechanisms and public policy continue to evolve to liberate rather than frustrate this clean energy dawn.

|

“What is unfolding is nothing less than a fundamental transformation of the world’s energy infrastructure.”

Some findings from the report:

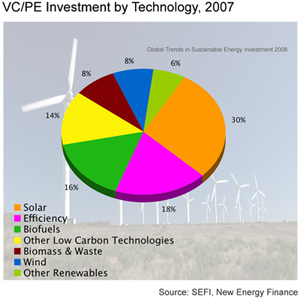

Biofuels: Venture capital and private equity investment in biofuels fell by almost one-third in 2007, to $2.1 billion, due to rising feedstock costs in the U.S. and falling ethanol prices. Brazil, India and China saw increased investment in the sector.

Solar: Solar saw the most venture capital and private equity investment ($3.7 billion) in 2007. Chinese solar companies raised $2.5 billion on the US and Europe equity markets during the year.

Energy efficiency: Investment in energy efficiency technology rose 78% to a record $1.8 billion. Buildings offer the greatest energy saving potential (representing the source of 40% of CO2 emissions). The International Energy Agency estimates that each dollar invested in energy efficiency avoids an average of more than $2 in costs to create new supply.

|

Emerging markets of China, Brazil, and India: Excluding hydroelectric power, investment in renewable energy capacity in China increased by more than four times, to $10.8 billion, and new wind capacity doubled to 6 gigawatts. Brazil continues to be the world’s largest renewable energy market, due to hydropower and bioethanol industries. India saw $2.5 billion in renewable energy project financing, mostly for 1.7GW of new wind projects.

Africa: Africa still lags in sustainable energy investment but “has the most to gain from renewable energy”

Carbon finance: $13 billion had been invested in carbon funds by the end of 2007. The funds are an important source of investment for “Clean Development Mechanism” projects in developing countries. 2007 saw the first private equity investments in post-2012 CDM credits, including the potential credits from “Reducing Emissions from Deforestation and Degradation” (REDD), a mechanism for offsetting emissions by conserving tropical forests.

Public investment: Assets under management in clean energy funds rose to $35 billion in 2007 while general public investments, through stock and other markets, more than doubled to $23.4 billion, up from $10.5 billion in 2006. 17 new clean energy public equity funds launched in 2007, up from five in 2006.

Research & Development: Research & Development spending on clean energy and energy efficiency was $16.9 billion in 2007, including corporate R&D of $9.8 billion, and government R&D of $7.1 billion.

This article is based on press materials from UNEP