- After years of research, economics experts say they can prove that financial markets respond swiftly and definitively when multinationals are publicly named in connection with the assassination of an environmental defender.

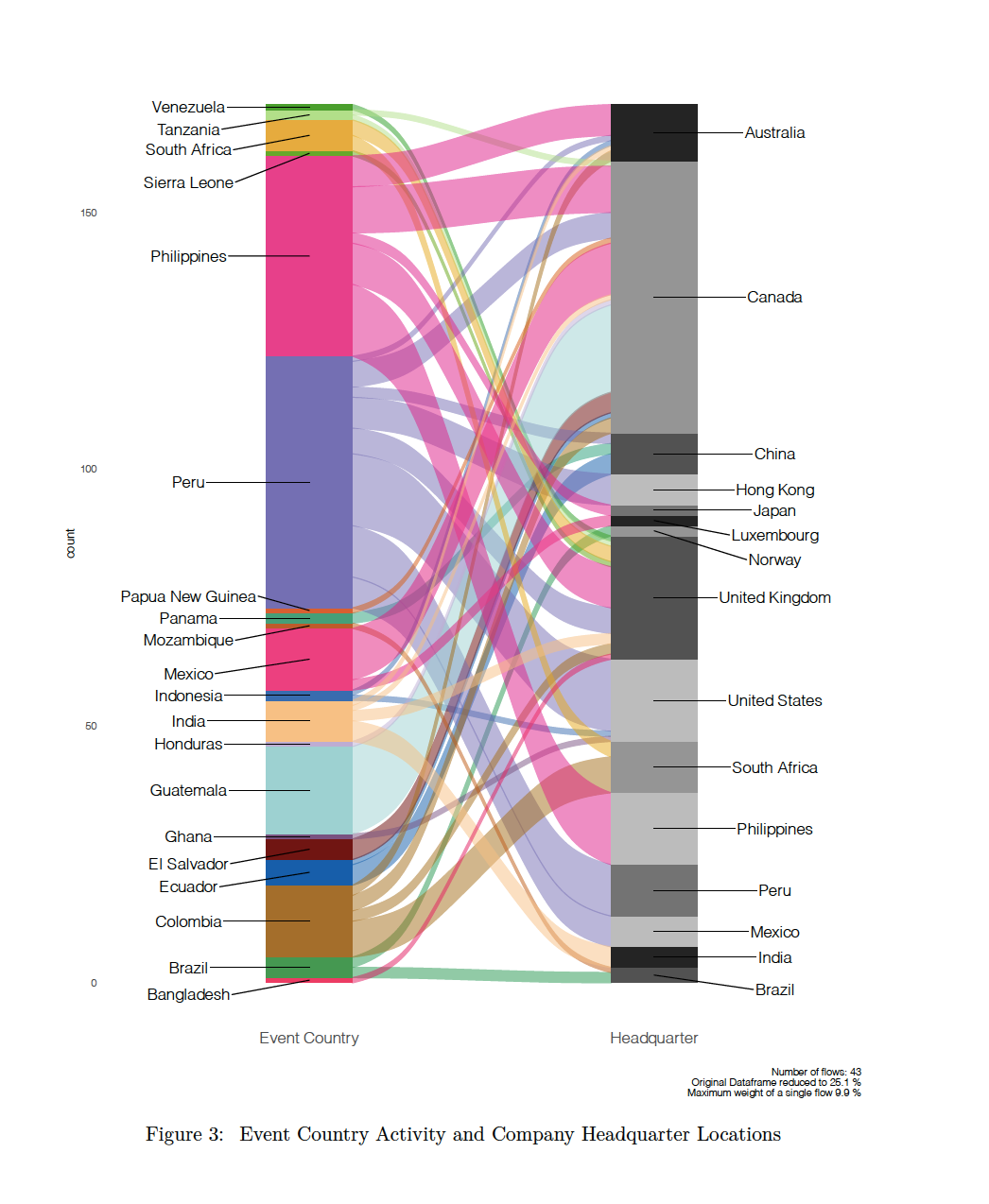

- The researchers analyzed 354 assassinations over two decades connected to mining and extractive minerals projects around the world, noting particularly significant violent action in the Philippines and Peru.

- Once a company is named, the data show that within 10 days the markets respond, hitting the company with a median loss in market capitalization of more than $100 million.

The old adage of “money talks” is being given a modern data analysis stress test and applied to the assassinations of civil society activists in the global mining sector. In fact, according to a trio of economics experts from Oxford University and Australia’s Monash University who have taken on the subject, it is simply bad business for a multinational firm to be associated with a publicly reported murder.

This is especially true if some key baseline factors are in play: notably, a slow news day and a specific company connected by name with the violence-associated project. That naming must also be done through the media, or a civil society organization like a nonprofit human rights organization.

For the Oxford-Monash study, the team analyzed data stretching back to 1998 in the mining and extractive industries alone, eventually confirming the assassinations of 354 individuals over two decades in that sector globally. A key factor: small or highly leveraged firms tend to be more wrapped up with on-the-ground factors at the mining outfit, which can play into the impact of a publicized murder.

The more leveraged a firm, the more disruptive the news of a murder tends to be.

The cost to companies is undeniable: the researchers’ analysis calculates a median loss price tag of more than $100 million in market capitalization for a firm associated with an assassination. When the market does respond to such deaths, it does so swiftly, within 10 days of the murder being publicly reported.

The response is no humanitarian-driven divestment, though.

“By no means are they [multinationals] acting out of the goodness of their heart,” said Nathaniel Lane, lead author of the study, in a recent interview with Mongabay. Lane, who is an associate professor of economics at Oxford, notes that there is a “destabilizing” effect when a company is publicly linked to an assassination. That destabilization can lead to the market capitalization loss.

Publicizing information on a slow news day is crucial, though.

“These things do have more effect on a slow news day,” Lane said. “What’s come out from this — if you’re looking at the news pressure — on a slower news day the news is more significant.”

He adds that the team’s research points to a preponderance of financial market decision-makers with a hawkish approach to managing investments.

“The electronic eyes and ears of the market are kind of sensitive to this stuff,” Lane said.

Part of the analysis in the working paper includes collected news on murdered environmental defenders across the globe. That information was coded with multinationals that had projects involved in these assassinations, the aim being to demonstrate how markets respond to high-profile human rights abuses that make the news.

The team spent years collecting and analyzing data from media and human rights organizations over a 20-year period about assassinations of environmental activists who were opposed to a particular mining project. They used algorithmic and human searches, including the LexisNexis global database of popular media outlets in Spanish, French, English, and Portuguese.

Using market data from both the 10 days before and after the de facto murder date (when it was publicly reported), the associated mining or mineral extractive project response was then analyzed.

Researchers say that the numbers spell out a clear cause and effect: savvy market actors see the reporting of a murder associated with a named mining project as destabilizing, and respond by decreasing financial ties.

Among the countries considered in the research, Peru and the Philippines stand out as especially dangerous.

“The reporting we are drawing from tends to be pretty damning,” Lane said. “What we’re observing, and what we can observe, is probably most likely in our view to get to the commodities trader in New York. What the international markets are likely to pick up and trade on.”

Assassinations of environmental defenders across numerous sectors, including wildlife trafficking, illegal logging, habitat loss from infrastructure expansion, land use change, and so on, have raged out of control for years.

In a recent case in Colombia, for example, a state environmental official was assassinated around early December 2020. At the time, in that country alone, the body count of murdered environmental defenders across all sectors for only part of the year stood at 284 people.

Banner image: Gold mining is a major threat to the forests and biodiversity of the Peruvian Amazon, including protected areas. Photo by Rhett A. Butler.

Citation:

Kreitmeir, D., Lane, N., & Raschky, P. (2020). The value of names — Civil society, information, and governing multinationals on the global periphery. Retrieved from https://osf.io/download/5fdc2ee2149e7504f702c8d9/