There is no question that governments around the world are moving slowly and sluggishly to combat climate change, especially when placed against the measures recommended by climate scientists. Only a handful of nations have actually cut overall greenhouse gas emissions, and the past couple decades have seen emissions rise rapidly worldwide as nations like India and China industrialize while Brazil and Indonesia continue massive deforestation. Global temperatures are rising in concert (though with natural fluctuations): the past decade is the warmest on record. After the failure of Copenhagen this past December to produce an ambitious and binding treaty, many are wondering if the world will ever address the threat of climate change or if future generations are set to live in a world far different—and more volatile—than the one we currently enjoy.

However, even as pessimism is on the rise, new ideas are being pushed to the forefront. One of the biggest challenges to combating climate change is simply a lack of funds to kick-start the massive infrastructure and new energy systems needed to create a post-fossil fuel world, and while the cost of solar, wind, and geothermal energies are dropping they are still more expensive than coal and oil. To date governments have not moved fast enough or spent enough to produce the green revolution scientists say is needed. But professor John Mathews and consultant Sean Kidney believe that a simple economic mechanism is already available: bonds.

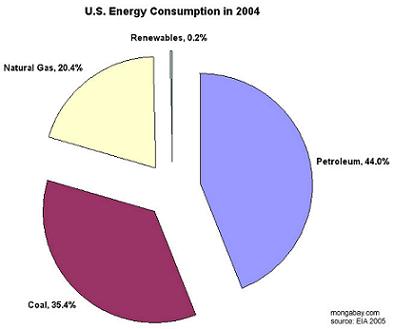

Renewable energy makes up less than one percent of energy consumption in the United States according to the Energy Information Administration’s Emissions of Greenhouse Gases in the United States 2004. |

In a recent article in Government: Business Foreign Affairs and Trade Mathews and Kidney outlined the idea of climate bonds and argued that such bonds could fund the transition from fossil fuels to green energy.

“The climate bonds idea is conceived as a completely normal, commercial financial instrument that offers cast iron guarantees of future returns to institutional investors,” Mathews, Chair of Strategic Management at Macquarie Graduate School of Management, told mongabay.com. “The bonds are backed by government-guaranteed agreements regarding renewable energy and other low-carbon technologies. Investors in climate bonds are investing in the new energy system that is slowly coming into being, and which gives certainty—rather than in the highly uncertain world of oil and fossil fuels.”

According to Mathews bonds have proven uniquely successful in the past to fund large and expensive projects, such as building America’s interstate highway in the 1950s, completing massive sewer projects in European cities in the 19th Century, or funding warfare, for example US’s ‘liberty bonds’ for World War I and a similar series of bonds for US World War II efforts.

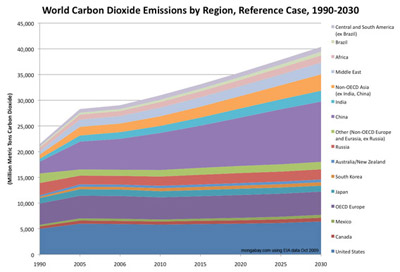

According to the Energy Information Administration, after China and the United States, among major polluters only India is expected to have significant growth of emissions over the next 20 years. |

Climate bonds, for their part, will “be targeted at renewable energies and low-carbon technologies,” says Mathews. “The problem for all societies looking to reduce their carbon footprint is how to overcome the ‘gap’ between paying out investments today and reaping a return tomorrow […] The bonds markets are the perfect instrument for raising such finance, where the entity issuing the bond has sufficient credibility (credit-worthiness) that it can back up a promise to pay over a period of, say, 20 to 30 years.”

Sean Kidney, policy adviser for government and corporations in London, argues that now is the perfect time to make ‘climate bonds’ a reality, especially in light of the global financial crisis.

“A higher proportion of savings than ever before is now going into pension funds and sovereign wealth funds (de facto pension funds). For these funds, the long-term paybacks of bonds ideally matches their long-term requirements—they can estimate the number of people retiring in 2030 and buy bonds that mature then to make sure they can pay those people, without risk that an equities crisis (like last year’s) will leave them short,” Kidney explains, adding that “this shift has been compounded by the financial crisis, which has made equities in general a much weaker option against other investment classes, especially bonds.”

Kidney says the idea is likely to make its way into corporate bonds as well, meaning that in the future green energy corporations may be able to issue their own ‘climate bonds’.

“The idea is that this would allow carbon sector companies to tap funds focused on green investments to shift their assets sideways into the low-carbon economy—at the end of the day we want to convert the old-industry system. But to make this work properly we need third party verification that the assets being linked are genuinely mitigation-relevant, and this is something we’re working on,” Kidney says.

But it’s not just ‘climate bonds’ that are on the horizon. The Prince’s Rainforest Project, headed by the UK’s Prince Charles, has proposed ‘rainforest bonds’ to support rainforest conservation efforts (and thereby lower carbon emissions) while supporting sustainable development in developing nations in the tropics. In effect the bonds are meant to provide sufficient funding to out-compete the many economic drivers of deforestation, such as plantations, paper products, timber, and mining. The bonds would not be repaid by the nations receiving the funds, but by wealthy countries.

The Amazon rainforest. |

“The ‘rainforest bonds’ are an interesting idea, but they are not really commercial entities; as formulated they would represent more of a charitable donation to a good cause,” says Mathews.

The Prince’s Rainforest Project states that wealthy nations would issue rainforest bonds as an innovative mechanism to support conservation and fight climate change.

According to the Prince’s Rainforest Project website: “[Developed nations] benefit from the important ecosystem services provided by rainforests and will suffer the consequences if tropical deforestation continues at its current rate. […] Moreover, in terms of climate change, the industrialized nations have been responsible for the bulk of carbon emissions over the past two hundred years and have the highest per capita emissions now; therefore, they will have to make the largest cuts if we are to achieve climate stability. Saving the rainforests will buy time to allow these emissions reductions to be made.”

The organization is currently working with the World Bank on the idea.

Of course, everyone knows that the fight against climate change is essentially a race against time—every year that goes by makes the task that much bigger. So, when can the we expect these ‘climate bonds’? Both Mathews and Kidney are optimistic that the bonds will take the financial world by storm sooner rather than later.

“This is not something that hangs on some new international agreement or global initiative,” Mathews explains. “A city, a state government, a national govt – any one of these could issue something called a climate bond any day. We are talking to many potential issuers and potential investors through the Climate Bonds Initiative: www.climatebonds.net. It’s going to happen much earlier than you expect.”

Kidney adds that “banks tell me that we’ll see a big growth this year. As soon as a credible labeling system is in place […] it will boom.”

For more information: www.climatebonds.net.

Related articles

China leaves US (and Europe) in the dust on renewable energy

(02/01/2010) This year China has become the world’s largest manufacturer of solar panels and wind turbines, doubling its wind capacity since 2005. The economically booming nation—and the world’s most populous—has also invested heavily in nuclear power and the world’s most efficient coal plants, according to the New York Times.

New report: world must change model of economic growth to avert environmental disaster

(01/25/2010) For decades industrialized nations have measured their success by the size of their annual GDP (Gross Domestic Product), i.e. economic growth. The current economic model calls for unending growth—as well as ever-rising consumerism—just to remain stable. However, a new report by the New Economics Foundation (nef) states that if countries continue down a path of unending growth, the world will be unable to tackle climate change and other environmental issues.

Pope Benedict: environmental crisis requires review of world’s economic model

(12/15/2009) Pope Benedict XVI has released a message linking world peace with preserving the environment for the World Day of Peace, which will be held on January 1st 2010. In it Benedict calls for a “long-term review” of the world’s current economic model, including “[moving] beyond a purely consumerist mentality” and encouraging a more “sober lifestyle”.