Report: U.S. ethanol sector does not need subsidies

The ethanol industry in the United States is booming and has achieved an impressive scale over the past two years. However, many critics have said this growth has come at a high cost for the American tax payer: the cost of all the tax breaks, direct subsidies and other benefits for corn-derived ethanol was estimated to total at least $5.1 billion last year (earlier post). Moreover, the sector is proteced by import tariffs on cheaper and more sustainable ethanol made in the developing world. Recently, a paper written for the 'OECD Roundtable on Sustainable Biofuels' (not affiliated with the OECD) warned that these subsidies are not effective, and that trade barriers prevent more sustainable and competitive biofuels from reaching the market (more here).

However, a new study by Dr Thomas Elam, agricultural economist for consulting firm FarmEcon, now shows that this heavy federal support is in fact not needed. The report titled "Fuel Ethanol Subsidies: An Economic Perspective" [*.pdf], states that with current oil prices, even America's corn-based ethanol, which is amongst the most costly biofuels, can survive without subsidies.

At current crude oil and gasoline price levels coupled with the Federal subsidy the ethanol industry can afford to pay about twice the 2003-2005 average price of corn. As long as oil remains above $55 per barrel, and more importantly wholesale gasoline above about $1.90 per gallon, ethanol producers can pay more than 2003-2005 corn prices. If crude oil were to go to $90 per barrel corn would be affordable to ethanol producers at up to $6.00 per bushel, including the Federal subsidy.

According to the report, this shows clearly that the case can be made that the subsidy for ethanol, if there is to be one at all, should be based on gasoline prices, not a flat amount per gallon of ethanol used for fuel. In fact, if oil prices go high enough the government should consider taxing ethanol used for fuel to alleviate the effects of ethanol demand on food prices:

energy :: sustainability :: biomass :: bioenergy :: biofuels :: ethanol :: subsidies :: tax breaks :: corn ::

energy :: sustainability :: biomass :: bioenergy :: biofuels :: ethanol :: subsidies :: tax breaks :: corn ::

According to Elam's study, federal supports, when fully implemented, will drive up the cost of corn and other grains by $34 billion per year. The ethanol boom is driving up the cost of food production, and could eventually cost a family of four about $460 a year in higher food costs.

Federal supports are severely distorting crop prices while adding little, if anything, to the stated goals of the renewable energy program, Elam said. The ethanol program is also increasing the federal outlays and has very little impact on U.S. dependence on foreign oil, the report says.

The study also contends that increased ethanol production will do little to reduce domestic dependence on foreign oil:

References:

Elam, Thomas, "Fuel Ethanol Subsidies: An Economic Perspective" [*.pdf], Report commissioned by The National Turkey Federation, National Chicken Council, American Meat Institute - September 19, 2007.

Biopact: Subsidies for uncompetitive U.S. biofuels cost taxpayers billions - report - October 26, 2006

Biopact: Paper warns against subsidies for inefficient biofuels in the North, calls for liberalisation of market - major boost to idea of 'Biopact' - September 11, 2007

However, a new study by Dr Thomas Elam, agricultural economist for consulting firm FarmEcon, now shows that this heavy federal support is in fact not needed. The report titled "Fuel Ethanol Subsidies: An Economic Perspective" [*.pdf], states that with current oil prices, even America's corn-based ethanol, which is amongst the most costly biofuels, can survive without subsidies.

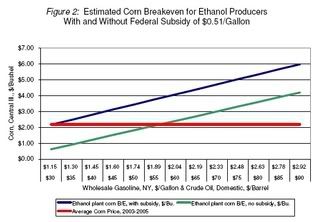

Ethanol is one of the most profitable enterprises in the United States today, but unfortunately a high percentage of those current profits come not from the marketplace, but from the federal treasury. Increased energy prices make it possible for the ethanol industry to thrive on its own. - Dr Thomas Elam, agricultural economistIn the chart above (click to enlarge) the breakeven ethanol value of corn is calculated based on the energy value of ethanol, current ethanol production costs, current ethanol yields and the current relationship between corn prices and distiller's dried grains with solubles (DDGS) prices. The chart uses the historic relationship between crude oil and U.S. wholesale gasoline prices to relate the value of gasoline to the value of crude oil.

At current crude oil and gasoline price levels coupled with the Federal subsidy the ethanol industry can afford to pay about twice the 2003-2005 average price of corn. As long as oil remains above $55 per barrel, and more importantly wholesale gasoline above about $1.90 per gallon, ethanol producers can pay more than 2003-2005 corn prices. If crude oil were to go to $90 per barrel corn would be affordable to ethanol producers at up to $6.00 per bushel, including the Federal subsidy.

According to the report, this shows clearly that the case can be made that the subsidy for ethanol, if there is to be one at all, should be based on gasoline prices, not a flat amount per gallon of ethanol used for fuel. In fact, if oil prices go high enough the government should consider taxing ethanol used for fuel to alleviate the effects of ethanol demand on food prices:

energy :: sustainability :: biomass :: bioenergy :: biofuels :: ethanol :: subsidies :: tax breaks :: corn ::

energy :: sustainability :: biomass :: bioenergy :: biofuels :: ethanol :: subsidies :: tax breaks :: corn :: According to Elam's study, federal supports, when fully implemented, will drive up the cost of corn and other grains by $34 billion per year. The ethanol boom is driving up the cost of food production, and could eventually cost a family of four about $460 a year in higher food costs.

Federal supports are severely distorting crop prices while adding little, if anything, to the stated goals of the renewable energy program, Elam said. The ethanol program is also increasing the federal outlays and has very little impact on U.S. dependence on foreign oil, the report says.

The study also contends that increased ethanol production will do little to reduce domestic dependence on foreign oil:

On a net energy basis, ethanol will not make a significant contribution to overall U.S. energy production/ If the ethanol industry achieves 100 percent E10 market share in the United States, it would take about 200 million tons of corn annually. This is equal to a 10 percent reduction in the current global grain supply. - Dr Thomas Elam, agricultural economistThe 51 cents per gallon tax credit given to fuel blenders who add ethanol to gasoline has caused significant increases in food costs and distorting farmer planting incentives, the report says.

Ethanol producers can easily afford to compete with U.S. livestock and poultry producers for corn. Even without subsidies, ethanol production would be expanding at a significant rate due to high gasoline prices and the improvements in ethanol production technology in recent years. - Dr Thomas Elam, agricultural economistThe American Meat Institute, National Chicken Council and National Turkey Federation commissioned Elam's study.

References:

Elam, Thomas, "Fuel Ethanol Subsidies: An Economic Perspective" [*.pdf], Report commissioned by The National Turkey Federation, National Chicken Council, American Meat Institute - September 19, 2007.

Biopact: Subsidies for uncompetitive U.S. biofuels cost taxpayers billions - report - October 26, 2006

Biopact: Paper warns against subsidies for inefficient biofuels in the North, calls for liberalisation of market - major boost to idea of 'Biopact' - September 11, 2007

--------------

--------------

A group of Spanish investors is building a new bioethanol plant in the western region of Extremadura that should be producing fuel from maize in 2009. Alcoholes Biocarburantes de Extremadura (Albiex) has already started work on the site near Badajoz and expects to spend €42/$59 million on the plant in the next two years. It will produce 110 million litres a year of bioethanol and 87 million kg of grain byproduct that can be used for animal feed.

A group of Spanish investors is building a new bioethanol plant in the western region of Extremadura that should be producing fuel from maize in 2009. Alcoholes Biocarburantes de Extremadura (Albiex) has already started work on the site near Badajoz and expects to spend €42/$59 million on the plant in the next two years. It will produce 110 million litres a year of bioethanol and 87 million kg of grain byproduct that can be used for animal feed.

2 Comments:

The U.S. is "Saving" about a Billion Dollars/mo on Agricultural Subsidies with the higher ag prices. We're, also, recouping in the neighborhood of $5 Billion/yr in various taxes associated with the ethanol Industry.

This has led us to be able to propose dropping our Ag Subsidy Cap from $26 B down to $13 B to help the Doha Round get restarted.

We'll probably look at the Blender's credit in a couple of years once we're convinced the industry is strong enough that the oil companies can't come in and strangle it.

Rufus

I don't think your comment gives the host too much solace.

Assuming some good faith in the first place, telling someone who wishes to produce effective net energy and food in a balanced way from Agro energy, that we (I am also an American) "saved" (or possibly redirected/externalized more accurate) $ 12 billion in agricultural subsidies - if its true - and we are now going to reduce such direct food subsidies going forward isn't really very comforting.

Looking at the true net energy profile of corn ethanol, particularly incrementally (but as Americans - ultimate energy consumers - we never consider energy has a cost so yes its difficult) I wouldn't be quite so sanguine that the long standing blenders credit and import barriers, the former at least I believe only mandated until 2009, will go away soon. But with increasing cost of energy, specifically gas (no matter how appropriate from an equalized energy cost perspective to avoid waste) more "green ethanol" will be made using Coal for heating as a proportion of the total.

While not nearly as aware of the underlying net energy profile of European Biofuels (I prefer Agro Energy) I suspect its not so much better ? and while industrially pragmatic and distribution cost effective using ethanol via ETBE and maintaining a large MTBE oxygenate use and also with large import bariers, Europe isn't so terribly green either.

If you believe even a highly discounted Brazil biofuels net energy calculation and understand how they maximize its use, particularly hydrous (more energy efficient), but don't encourage over consumption in general, and have been quite balanced in food and energy production, they are possibly the only virtuous Agro Energy producer in the world.

Post a Comment

Links to this post:

Create a Link

<< Home