Report: 2006 record year for investments in renewables, annual growth projected to be 17% through 2013

A new report [*.pdf] by New Energy Finance shows 2006 was another record year for Venture Capital (VC) and Private Equity (PE) investment in the clean energy sector, with $18.1bn invested in companies and projects. This represented a 67% increase on 2005 ($10.8bn), and beat New Energy Finance’s original forecast.

However, this rapid growth in VC & PE investment only tells half the story: a significant amount of money ($2bn) resides in funds and has yet to be invested. During 2006 clean energy VCs invested only 73% of the total money available to them – a symptom of a competitive market where demand for deals is outweighing supply, thereby driving up company valuations.

During 2006 more investors sought out opportunities in clean energy, in response to high oil prices and the need for action climate on change. New Energy Finance has identified 1,859 VC/PE investors who have either made investments or stated their intention to do so. The analysts recorded 193 funds that invest in clean energy, and analysed 521 VC and PE deals in 2006, totalling $8.6bn for companies and $9.5bn for projects. This trend has continued, with a total of $10.6bn invested in the first half of 2007 (see Figure 1, click to enlarge).

During 2006 more investors sought out opportunities in clean energy, in response to high oil prices and the need for action climate on change. New Energy Finance has identified 1,859 VC/PE investors who have either made investments or stated their intention to do so. The analysts recorded 193 funds that invest in clean energy, and analysed 521 VC and PE deals in 2006, totalling $8.6bn for companies and $9.5bn for projects. This trend has continued, with a total of $10.6bn invested in the first half of 2007 (see Figure 1, click to enlarge).

Out of the total VC & PE investment of $18.1bn, 61% ($11.1bn) represented new money into the clean energy sector, as investors provided capital for technology development, company expansion and project construction. The remaining money, $7.0bn, was used to finance company buy-outs, and re-finance and acquire projects. All regions experienced significant growth in 2006 (see Figure 2, click to enlarge).

Out of the total VC & PE investment of $18.1bn, 61% ($11.1bn) represented new money into the clean energy sector, as investors provided capital for technology development, company expansion and project construction. The remaining money, $7.0bn, was used to finance company buy-outs, and re-finance and acquire projects. All regions experienced significant growth in 2006 (see Figure 2, click to enlarge).

$7.1bn was invested in the Americas (AMER) - an increase of 83% on 2005 – as mainstream investors woke up to the opportunities in clean energy, especially in biofuels. Europe, Middle East & Africa (EMEA) saw $9.2bn invested (67% increase), mainly driven by PE investment in companies and projects. Companies and projects in the Asia & Oceania region (ASOC) received $1.8bn in investment (26% increase), driven by pre-IPO PE investments in Chinese solar companies and clean energy activity in other developing countries such as India.

At a sector level wind ($8.4bn), biofuels ($4.7bn) and solar ($2.3bn) attracted the majority (86%) of VC/PE investment (see Figure 3, click to enlarge). Mature technologies, such as on-shore wind and first generation/cornbased ethanol, attracted PE money for expansion and roll-out of production capacity. Solar raised a significant amount of money via the public markets, but also attracted the highest level of classic VC investment ($428m) typically into thin film and non crystalline silicon technologies. VC investment in in second generation biofuels technologies, including cellulosic ethanol, also increased ($235m):

At a sector level wind ($8.4bn), biofuels ($4.7bn) and solar ($2.3bn) attracted the majority (86%) of VC/PE investment (see Figure 3, click to enlarge). Mature technologies, such as on-shore wind and first generation/cornbased ethanol, attracted PE money for expansion and roll-out of production capacity. Solar raised a significant amount of money via the public markets, but also attracted the highest level of classic VC investment ($428m) typically into thin film and non crystalline silicon technologies. VC investment in in second generation biofuels technologies, including cellulosic ethanol, also increased ($235m):

energy :: sustainability :: renewables :: biomass :: bioenergy :: biofuels :: wind :: solar ::

energy :: sustainability :: renewables :: biomass :: bioenergy :: biofuels :: wind :: solar ::

Encouragingly the average VC deal size has increased in the past year at almost each development stage (see Figure 4, click to enlarge). Average series C/third round investment rose 29% to $14.8m and average series D/fourth round deal size almost doubled to $20.7m indicating investor confidence in companies with technologies closer to commercialisation.

Encouragingly the average VC deal size has increased in the past year at almost each development stage (see Figure 4, click to enlarge). Average series C/third round investment rose 29% to $14.8m and average series D/fourth round deal size almost doubled to $20.7m indicating investor confidence in companies with technologies closer to commercialisation.

The annual report of VC/PE activity in clean energy technologies, companies and projects examines the investment trends in 2006 and the first half of 2007. The analysts divide deals into the following investment types:

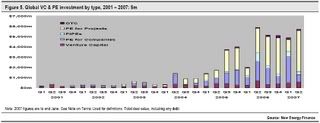

The leading investors are establishing successful track records and experiencing traditional venture style returns. All stages of VC and PE have seen a continued growth in investment activity in the first half of 2007, with VC investments already putting on a strong show (see Figure 5, click to enlarge). Based on industry-standard levels of leverage, we estimate that the amount of equity deployed during 2006 was $9.4bn. This represents 9% of the total transaction volume in clean energy in 2006 ($100.4bn).

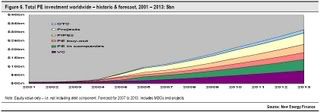

New Energy Finance has updated its forecast of VC/PE investment from 2007. It now estimates that the total VC and PE invested in clean energy will grow at an annual compound rate of approximately 17% through to 2013 (see Figure 6, click to enlarge). During this period, the analysts expect over $262bn worth of VC and PE funded deals to be completed, absorbing over $146bn of equity. This will be leveraged in terms of later stage deals, buyouts and project financings, although the recent squeeze in the credit markets has yet to have an impact, and may slow down growth in some areas.

References:

New Energy Finance: Cleaning Up 2007. Growth in Private Equity & Venture Capital Investment in Clean Energy Technologies, Companies & Projects [*.pdf] - August 2007.

However, this rapid growth in VC & PE investment only tells half the story: a significant amount of money ($2bn) resides in funds and has yet to be invested. During 2006 clean energy VCs invested only 73% of the total money available to them – a symptom of a competitive market where demand for deals is outweighing supply, thereby driving up company valuations.

During 2006 more investors sought out opportunities in clean energy, in response to high oil prices and the need for action climate on change. New Energy Finance has identified 1,859 VC/PE investors who have either made investments or stated their intention to do so. The analysts recorded 193 funds that invest in clean energy, and analysed 521 VC and PE deals in 2006, totalling $8.6bn for companies and $9.5bn for projects. This trend has continued, with a total of $10.6bn invested in the first half of 2007 (see Figure 1, click to enlarge).

During 2006 more investors sought out opportunities in clean energy, in response to high oil prices and the need for action climate on change. New Energy Finance has identified 1,859 VC/PE investors who have either made investments or stated their intention to do so. The analysts recorded 193 funds that invest in clean energy, and analysed 521 VC and PE deals in 2006, totalling $8.6bn for companies and $9.5bn for projects. This trend has continued, with a total of $10.6bn invested in the first half of 2007 (see Figure 1, click to enlarge). Out of the total VC & PE investment of $18.1bn, 61% ($11.1bn) represented new money into the clean energy sector, as investors provided capital for technology development, company expansion and project construction. The remaining money, $7.0bn, was used to finance company buy-outs, and re-finance and acquire projects. All regions experienced significant growth in 2006 (see Figure 2, click to enlarge).

Out of the total VC & PE investment of $18.1bn, 61% ($11.1bn) represented new money into the clean energy sector, as investors provided capital for technology development, company expansion and project construction. The remaining money, $7.0bn, was used to finance company buy-outs, and re-finance and acquire projects. All regions experienced significant growth in 2006 (see Figure 2, click to enlarge).$7.1bn was invested in the Americas (AMER) - an increase of 83% on 2005 – as mainstream investors woke up to the opportunities in clean energy, especially in biofuels. Europe, Middle East & Africa (EMEA) saw $9.2bn invested (67% increase), mainly driven by PE investment in companies and projects. Companies and projects in the Asia & Oceania region (ASOC) received $1.8bn in investment (26% increase), driven by pre-IPO PE investments in Chinese solar companies and clean energy activity in other developing countries such as India.

At a sector level wind ($8.4bn), biofuels ($4.7bn) and solar ($2.3bn) attracted the majority (86%) of VC/PE investment (see Figure 3, click to enlarge). Mature technologies, such as on-shore wind and first generation/cornbased ethanol, attracted PE money for expansion and roll-out of production capacity. Solar raised a significant amount of money via the public markets, but also attracted the highest level of classic VC investment ($428m) typically into thin film and non crystalline silicon technologies. VC investment in in second generation biofuels technologies, including cellulosic ethanol, also increased ($235m):

At a sector level wind ($8.4bn), biofuels ($4.7bn) and solar ($2.3bn) attracted the majority (86%) of VC/PE investment (see Figure 3, click to enlarge). Mature technologies, such as on-shore wind and first generation/cornbased ethanol, attracted PE money for expansion and roll-out of production capacity. Solar raised a significant amount of money via the public markets, but also attracted the highest level of classic VC investment ($428m) typically into thin film and non crystalline silicon technologies. VC investment in in second generation biofuels technologies, including cellulosic ethanol, also increased ($235m): energy :: sustainability :: renewables :: biomass :: bioenergy :: biofuels :: wind :: solar ::

energy :: sustainability :: renewables :: biomass :: bioenergy :: biofuels :: wind :: solar ::  Encouragingly the average VC deal size has increased in the past year at almost each development stage (see Figure 4, click to enlarge). Average series C/third round investment rose 29% to $14.8m and average series D/fourth round deal size almost doubled to $20.7m indicating investor confidence in companies with technologies closer to commercialisation.

Encouragingly the average VC deal size has increased in the past year at almost each development stage (see Figure 4, click to enlarge). Average series C/third round investment rose 29% to $14.8m and average series D/fourth round deal size almost doubled to $20.7m indicating investor confidence in companies with technologies closer to commercialisation.The annual report of VC/PE activity in clean energy technologies, companies and projects examines the investment trends in 2006 and the first half of 2007. The analysts divide deals into the following investment types:

- Venture Capital describes the funding of development and commercialisation of new technologies, products and services. Of the $8.6bn total investment into companies 2006, classic venture capital for technology and expansion accounted for $1.6bn, with the US based companies receiving $1.3bn (81%).

- Private Equity for Companies is investment in later-stage companies which have sufficiently mature businesses to allow some leverage, or which require capital to fund business assets. $3.2bn of private equity investment into companies was recorded, as European and Asian companies geared up for further fund raising via the public markets. A further $1.8bn changed hands through buy-outs and corporate spin-offs.

- Private Equity for Projects defines investment in individual renewable energy or biofuels projects, or portfolios of such projects. A massive $9.5bn worth of renewable energy projects were financed in 2006 by PE investors (utilising significant leverage), with wind the dominant sector ($6.7bn), then biofuels and biomass ($1.7bn).

- Private Investment in Public Equity (PIPE) is a transaction in which a PE-type investor takes a significant stake in a company quoted on the public markets. New investors drove PE investment in over-the-counter (OTC) markets and PIPEs to a total of $1.9bn, more three times the investment in 2005.

The leading investors are establishing successful track records and experiencing traditional venture style returns. All stages of VC and PE have seen a continued growth in investment activity in the first half of 2007, with VC investments already putting on a strong show (see Figure 5, click to enlarge). Based on industry-standard levels of leverage, we estimate that the amount of equity deployed during 2006 was $9.4bn. This represents 9% of the total transaction volume in clean energy in 2006 ($100.4bn).

New Energy Finance has updated its forecast of VC/PE investment from 2007. It now estimates that the total VC and PE invested in clean energy will grow at an annual compound rate of approximately 17% through to 2013 (see Figure 6, click to enlarge). During this period, the analysts expect over $262bn worth of VC and PE funded deals to be completed, absorbing over $146bn of equity. This will be leveraged in terms of later stage deals, buyouts and project financings, although the recent squeeze in the credit markets has yet to have an impact, and may slow down growth in some areas.

References:

New Energy Finance: Cleaning Up 2007. Growth in Private Equity & Venture Capital Investment in Clean Energy Technologies, Companies & Projects [*.pdf] - August 2007.

--------------

--------------

Virent Energy Systems, Inc. announced today that it has closed a US$21 million second round of venture financing. Investor interest in Virent was driven in large part by the Company’s continued development of its innovative BioForming process beyond its traditional hydrogen and fuel gas applications and toward the production of bio-based gasoline, diesel, and jet fuels.

Virent Energy Systems, Inc. announced today that it has closed a US$21 million second round of venture financing. Investor interest in Virent was driven in large part by the Company’s continued development of its innovative BioForming process beyond its traditional hydrogen and fuel gas applications and toward the production of bio-based gasoline, diesel, and jet fuels.

0 Comments:

Post a Comment

Links to this post:

Create a Link

<< Home