With commodity prices surging, lending to Brazilian farmers for tractors, harvesters and plows reached 8.2 billion reais ($4.8 billion) for the July through November 2010 period, a 64 percent increase since the same period last year and the fastest pace since 2004, reports Bloomberg.

Banco do Brasil, the country’s biggest state-owned bank and the largest farm lender, boosted lending for agricultural capital equipment 38 percent for the first five months of the harvest season. The increase was also the biggest since 2004. Overall, commercial farm lending grew 29 percent to $49.8 billion this harvest season.

The news that agricultural lending is rising does not come as a surprise. Commodity markets are booming: soy and sugar prices have climbed more than 30 percent in the past year, while beef is up by 25 percent and coffee prices jumped 60 percent. Brazil is the world’s largest producer of sugarcane, coffee, and cattle, and trails only the United States in soybean production.

But increased lending to the agricultural sector may raise environmental concerns, particularly in the Amazon rainforest and cerrado, a vast savanna that borders the Amazon and is the primary area of expansion for agriculture.

|

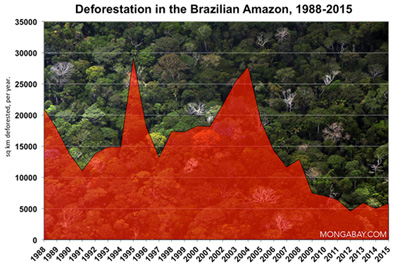

Commodity production is a key driver of deforestation in the Brazilian Amazon and the last time lending rose this fast was 2004, a year when deforestation in the Brazilian Amazon reached 27,772 square kilometers, the second highest level on record (in 1995 29,059 square kilometers were cleared). Analysis released earlier this month by Imazon, an NGO, found that forest degradation, which is often a pre-cursor to outright deforestation, has risen sharply in recent months. Degradation this year has been exacerbated by a severe drought, which has caused rivers in the Amazon Basin to fall to record lows. The drought has turned vast tracts of the Amazon into a tinderbox, worsening the impact of land-clearing fires set by ranchers and farmers.

Nevertheless, Brazilian lending institutions have put some safeguards in place since 2004. Last year, BNDES, Brazil’s national development bank, mandated a zero-deforestation policy for cattle production. The bank, which lends more money than the World Bank, now requires meatpackers to have a traceability system to ensure cattle production does not result in deforestation. BNDES has also launched a 1 billion reais ($588 million) fund to finance projects to reduce greenhouse gas emissions associated with agriculture. Meanwhile, Banco do Brasil earlier this month announced it will now require farmers applying for credit to certify the origin of their soybeans to ensure production does not come at the expense of ecologically sensitive areas. Private banks like Rabobank have also implemented stricter environmental criteria for lending to the agricultural sector.

Related articles