An industry-led moratorium on soy plantings on recently deforested rainforest land continues to show success in the Brazilian Amazon, reports a study released Tuesday by environmental groups and Abiove, the soy industry group that formed the initiative and represents about 90 percent of Brazil’s soy crush.

The satellite-based study showed that only 12 of 630 sample areas (1,389 of 157,896 hectares) deforested since July 2006 — the date the moratorium took effect — were planted with soy. Clearing for cattle pasture remains a much bigger driver of deforestation — accounting for over 80 percent of forest conversion in the legal Amazon.

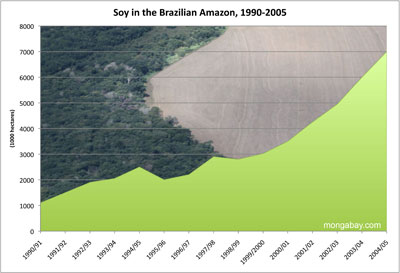

Soy expansion in the Legal Amazon (Amazônia). Enlarge image. |

While the sample was small — covering 157,896 hectares in a region where individual soy farms can extend over thousands of hectares — it provided a hopeful sign that soy producers are abiding by the moratorium, which was established as a response to environmentalists who said that soy was driving Amazon rainforest destruction. Producers feared they would lose access to international markets.

Better capitalized and dependent on exports, soy producers in the Brazilian Amazon proved an easier target for environmentalists than cattle ranchers. Cattle ranching is as much a vehicle for land speculation as it is for beef production across much of the Amazon — cleared land can be worth more than four times standing forest. Nevertheless responsible cattle ranchers have turned to the soy ban as a means to legitimize their own industry. Aliança da Terra, an NGO formed by Texas rancher John Cain Carter, is now working with hundreds of properties to promote environmental stewardship in return for access to lucrative overseas markets.

Soy in the Amazon

Soy fields and transition forest in Mato Grosso, Brazil |

Soy production in the Amazon exploded in the early 1990s following the development of a new variety of soybean suitable to the soils and climate of the region. Most expansion occurred in the cerrado, a wooded grassland ecosystem, and the transition forests in the southern fringes in the Amazon basin, especially in states of Mato Grosso and Pará — direct conversion of rainforests for soy has been relatively limited. Instead, the impact of soy on rainforests is generally seen by environmentalists to be indirect. Soy expansion has driven up land prices, created impetus for infrastructure improvements that promote forest clearing, and displaced cattle ranchers to frontier areas, spurring deforestation.

The Brazilian soy industry argues that it receives an unfair share of the blame for Amazon forest loss. It notes that producers in the legal Amazon face some of the most stringent environmental laws in the world, with landowners required to maintain 80 percent forest cover on their holdings. By comparison there are no legal forest reserve requirements for U.S. farmers.

More about soy in the Amazon

Beef drives 80% of Amazon deforestation

(01/29/2009) Nearly 80 percent of land deforested in the Amazon from 1996-2006 is now used for cattle pasture, according to new maps released today in a report by Greenpeace at the World Social Forum in Belem, Brazil. The report, Amazon Cattle Footprint: Mato Grosso: State of Destruction, confirms that cattle ranching is the primary driver of deforestation in Earth’s largest rainforest: the Brazilian Amazon.

ADM takes step towards more sustainable soy production in the Amazon

(01/27/2009) Agricultural giant Archer Daniels Midland Co. (ADM) has partnered with Brazilian nonprofit Aliança Da Terra to promote better environmental stewardship among soybean producers operating in the Amazon, reports the Chicago Tribune.

What does slowing economy mean for rainforest conservation?

(01/26/2009) Plunging commodity prices may offer a reprieve for the world’s beleaguered tropical forests. The global economic downturn has caused demand for many commodities to plummet. The resulting decline in the prices of timber, energy, minerals and agricultural products may do what conservationists have largely failed to achieve in recent years: slow deforestation. Fueled by surging demand from China and other emerging economies, and boosted by the convergence of food and energy markets in response to American and European incentives for biofuels, the worldwide commodity boom over the past few years helped trigger a land rush that precipitated the conversion of natural forests for farms, plantations, and ranches. At the same time, high prices for metals, fossil fuels, and other industrial resources drove a global search for exploitable reserves, many of which lie in tropical forest countries. Now that the bonanza is unwinding, with prices for everything from palm oil to bauxite to crude oil cratering, the incentives to clear forests are retreating. Developers large and small are abandoning projects and forgoing planned expansion around the world.

Agricultural firms cut incentives for Amazon deforestation

(12/02/2008) As grain prices plummet and concerns over cash mount, agricultural giants are cutting loans to Brazilian farmers, reports the Wall Street Journal. Tighter farm credit may be contributing to a recent slowing in deforestation in the Brazilian Amazon, where agriculture is an increasingly important driver of forest clearing.

Future threats to the Amazon rainforest

(07/31/2008) Between June 2000 and June 2008, more than 150,000 square kilometers of rainforest were cleared in the Brazilian Amazon. While deforestation rates have slowed since 2004, forest loss is expected to continue for the foreseeable future. This is a look at past, current and potential future drivers of deforestation in the Brazilian Amazon.

Amazon soy moratorium extended; may be expanded to other products

(06/23/2008) Soy crushers operating in the Brazilian Amazon have extended a two-year-old moratorium on the purchase of soybeans produced on rainforest lands deforested after 2006, reports Reuters.

Amazon beef producer creates eco-certified meat product with help of scientists

(06/08/2008) Independencia Alimentos SA, Brazil’s fifth-largest beef producer, will create an “eco-certified”, branded beef product from the Amazon’s Xingu region. Certification will be based on criteria established by Alian?a da Terra, an Brazilian NGO that seeks to improve the environmental performance of ranchers and beef producers in the world’s largest rainforest. The new beef product will include a per-kilo “ecosystem service fee” — calculated with the help of scientists at the Woods Hole Research Center — to facilitate a financial reward for the producer’s environmental stewardship.