Carbon tax will ease transition to sensible climate policy

Don’t “Sell Short” the Earth:

Carbon tax will ease transition to sensible climate policy

Richard B. Rood and Gabriel Thoumi

August 13, 2008

|

|

The management of carbon dioxide and the climate represent both an economic development challenge and the ecological problem of the next hundred years. Energy use, economic success and carbon dioxide emissions are, currently, intertwined. A carbon market that represents the true cost of energy and the disposal of our waste products in the environment is a potential long-term policy mechanism for carbon dioxide management. However, the strong interconnection between carbon dioxide emissions and economic success distinguishes the carbon market from other environmental markets used to control pollution. Therefore evolution to that solution is not straightforward; there are a series of necessary steps needed to develop a market.

A number of “carbon markets” have been started, for example the European Union Emissions Trading Scheme (EU ETS), and a number of new markets are proposed, for example the Western Climate Initiative in the United States. Point Carbon provides news and analysis of carbon markets. For these markets to achieve their ultimate goals of valuation of carbon dioxide emissions and reduction of carbon dioxide emissions, significant evolution and expansion of the markets must be realized. This article explores some of the hurdles that are necessary to cross in order to realize a successful CO2 market.

The analysis converges to a set of conclusions. A stable evolution of policy to support the development of a carbon market is needed. Part of the development of the market is the use of fee-based policy; that is, taxes and tax credits. These taxes help to provide valuation to efficient use of energy, to bridge the cost gap between carbon intensive and carbon free fuels, and to develop viable abatement strategies. The fees also help to provide a link between energy policy and climate policy. This recognizes that the urgency of energy policy will trump climate policy, and that there are solutions to energy security that negatively impact the climate. Ultimately, it is required that energy security and climate security be de-correlated if we are going to maintain economic stability on a planet supporting billions of consumers.

Market Basics

It is useful, first, to expose the attributes of a market. A market is a system that allows for exchange of quantities of expected risk and expected return, using various forms of capital within a regulated, contractually determined time frame. A well functioning market provides liquidity, assurance of completion, and transparency. Liquidity is the ability for market participants to convert an asset into capital in a timely fashion. Transparency refers to the ability for market information to be accurate, timely, and available to all participants. Finally, all markets must have assurance of completion, which is the guarantee that the intended transaction can be carried out, lessening systematic market risk. Non-systematic risk may occur if a counterparty defaults before the completion of a transaction, but this is not the responsibility of the market. An environmental market must also have a way to verify that the required environmental impact is achieved.

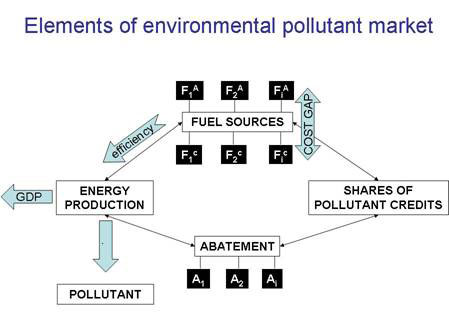

Figure 1: Schematic of an environmental market to control pollution associated with the generation of energy. See text for description. Figure 1: Schematic of an environmental market to control pollution associated with the generation of energy. See text for description. |

Figure 1 is a schematic, which represents an energy-related market for controlling environmental emissions. The top box represents the fuel and multiple choices of fuel sources. There are two classes of fuel represented. Those on the bottom Fic are fuels that produce the pollutant (CO2) when they are converted to energy. These fuels are identified with the traditional fossil fuels; coal, oil, and natural gas. Many of the biofuels that are advocated as alternatives to the fossil fuels are also substantial CO2 emitters. The fuels on top, Fia , do not produce the pollutant. Energy sources such as wind power, solar power, and nuclear power are examples of such fuels. There is a presumed cost gap between the carbon dioxide emitting fuels on the bottom of the fuel sources box and the clean fuels on the top of the box.

The box on the bottom is abatement; that is, the actions that are taken to remove the pollutant after it is produced. There is the possibility of abatement by capturing the CO2 emission as it is produced and sequestering the CO2 in the ground or in the ocean. There are also the natural sinks of atmospheric carbon dioxide. One of these sinks is associated with terrestrial ecosystems, and in particular, forests. Other potentially more permanent sinks of carbon dioxide are oceanic. Carbon dioxide is dissolved in the ocean and organisms in the ocean use carbon dioxide. These represent, in the ocean, both a chemical and a biological sink of atmospheric CO2.

The box on the left represents energy production, which is currently an analogue measure of economy (Gross Domestic Product, GDP) and pollutant production. There is assumed to be some measure of efficiency that describes the conversion of fuel to energy. The box on the right represents the trading of some fungible product, which represents shares of pollutant credit; that is, the cost of emitting CO2 into the atmosphere. These shares of CO2 are related to some level of CO2 pollution that is determined to be sustainable in the environment; that is, a cap of total CO2 concentration. A functional market relies on the cost of reduction of carbon emissions through purchasing of shares to be comparable to the cost of abatement or the cost of using a fuel with lower pollution emissions. These costs stand in relation to a penalty cost that comes from non-compliance. There is also the sure possibility of reducing emissions by generation of less energy, which is generally not considered a viable alternative.

The use of market-based approaches to control carbon dioxide emissions is often motivated by the success in the United States (U.S.) of an environmental sulfur market to control the emissions of sulfur dioxide (SO2), which is a primary cause of acid rain (see article by Robert Stavins at Resources for the Future). An analysis of the differences between the sulfur market and the putative carbon market is useful. There is one fundamental difference to point out in the beginning; that is, not only is CO2 an environmental pollutant, but it is currently a direct measure of energy production and, hence, economic and societal success. In a society whose success is based on burning fossil fuels, the emission of carbon dioxide is a measure of success.

Sulfur dioxide, in contrast, is a trace pollutant, and its production is not a direct measure of energy generation or economic success. Sulfur content can be cast as a measure of cleanliness of the fuel source, and there are different levels of fuel cleanliness. Because sulfur is a trace pollutant, it is easy to project that sulfur can be removed at a marginal cost relative to both the total cost and total energy production. There are several choices that are possible.

Sulfur emissions can be reduced in several ways. For example, in the traditional fossil fuels, coal, oil, and natural gas, there is variation in trace sulfur amounts across these fuels and within different grades of a particular type of fuel. The sulfur emission can, therefore, be reduced by changing fuels; for example, choosing high or low sulfur coal. The cost of reducing the production of sulfur dioxide is then directly calculated by the difference between clean and dirty fuel.

The cost of reducing the production of sulfur dioxide by fuel choice can be directly evaluated with comparison to the cost of abatement. Technology exists that offers several methods for removal of sulfur by processing the emissions that come from burning fossil fuels (This removal is known as scrubbing.). The market is made whole by the existence of sulfur credits. The sulfur credits are strongly constrained by the total amount of sulfur dioxide that is allowed, by regulation, to enter the atmosphere. This is the “cap” in a “cap and trade” system, and the cap represents the interface between scientific evaluation of the environment’s ability to process sulfur dioxide, the financial market, and policy. Explicitly, a cap and trade system requires that there be a level of pollutant that is determined to be tolerable in the environment.

The value of the sulfur credits is determined by the market. The credits reflect the decisions made by sulfur emitters on choices between clean and dirty fuel and forms of abatement. The robustness of the market is dependent on the cost of the shares being comparable to the marginal cost of fuel and abatement choices. The sustainability of the market requires that a balance exists across this spectrum of choices. These choices will include a penalty if sulfur emissions exceed a prescribed amount. The system can be optimized within an appropriate market risk — expected return analysis allows diversification to decrease risk of pollution arising from burning fuel.

The problem of controlling atmospheric sulfur is also different from controlling atmospheric carbon dioxide in another important way. The atmospheric lifetime of SO2 is short enough to allow the determination of links between our actions and results — in this case, the reduction of acid precipitation. The short life time keeps the impact of the sulfur emissions regional; for example, the control of emissions in the U.S. Middle West shows benefit in the U.S. Northeast. The lifetime of carbon dioxide is very long, and therefore, carbon dioxide mixes on a global scale. Any action taken to control carbon dioxide will not be observed to have measurable benefit for many years or decades. This provides major challenges to the verification that the market, especially a regional market, is having the needed environmental impact. Benefits from regional actions will be spread out over the globe. This diffusion of benefit provides an emotional barrier for actions.

The varieties of fuel and abatement choices that exist for the sulfur market do not exist for the carbon market; hence, meaningful valuation in a carbon market is difficult. For the conventional fossil fuels, coal, oil, and natural gas, there are important differences between their carbon emissions; however for all, carbon dioxide is a primary combustion product. Because of the slow atmospheric loss rate of CO2, all lead to an accumulation of CO2 in the atmosphere. Because of high switching costs, it is not easy to change between types of fuel to reduce carbon dioxide. The distribution of fuel use across the economy compounds the problem as does, for example, fractional and dispersed electricity generation plant regulations at local, regional, national, and international levels. This heterogeneous source and regulation environment stands in contrast to the need for global regulation of carbon. In total, it is not simple to link market success to desired outcome — mitigation of global warming. Plus, the benefit is far in the future.

The fuels that are on the top of the fuel sources box in Figure 1, Fia , do not, by definition, generate CO2 when energy is produced from them. If this category of fuels produced energy at the same cost as the fossil fuels, then they could, potentially, participate meaningfully in the market. Currently, there is a cost threshold. This cost threshold needs to be crossed before the fuel options on the top become competitive with those on bottom.

On the abatement side, the same problem exists; there are no choices yet of carbon abatement that scale to the valuation of a share of carbon credit. Current abatement options rely primarily on the use of terrestrial or oceanic sinks. These are minimally controversial options, in part because there are environmental impacts of increased storage of carbon in terrestrial and oceanic ecosystems. Furthermore, neither the valuation nor the efficacy of these sinks is established. An analogue to sulfur scrubbing, carbon removal and sequestration, does not exist as a market-scale, cost-effective option.

Efficiency connects the use of fuel to the generation of energy, and if the fuel is used more efficiently then the same energy will be generated with less pollution. Greater efficiency does not automatically assure CO2 reduction. For example, increased efficiency in transportation could be matched by longer trips, more powerful engines, or purchase of additional vehicles. Therefore an essential element of the market would be the valuation of efficiency, and the ability of participants to trade that valuation. A market that exists as a balance between efficiency costs and a penalty for exceeding emissions is, effectively, a pollution fee or tax.

The management and cost of management of the sulfur waste is relatively simple compared with the CO2 waste. The analysis above exposes some of the differences and offers some policy strategies which will be discussed more fully below.

Participation in Markets: Rational Convergence

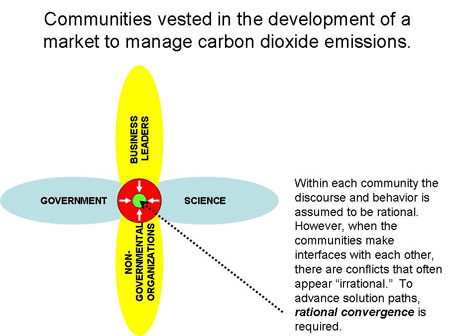

As is intuitively understood, there are emotional or psychological factors which contribute to the choice of whether or not an individual or institution participates in a market. Currently, the primary communities, which are framing the discussion of carbon markets, global warming, and climate change, can be placed into four groups: scientists, government, business leaders, and non-governmental organizations (NGOs). NGOs are assumed to represent, explicitly, values that may not have obvious market valuation. Each community is assumed to be acting to maximize their economic rent or self interest. Behavior in each of the four communities is assumed to be rational within the context of the community. As the discourse crosses from one community to another, the conclusions and assertions of one community can appear as irrational to the others. Within the context of the return-maximizing, risk-adverse rational market participant, irrationality is not a desired trait. Furthermore, it inhibits the development of trust, and it inspires a lack of transparency. This affects the assurance of completion of formal and informal contracts between market participants. Therefore, we suggest that participation in the global carbon market must appear rational to all four market participants; the interactions between the different groups must converge in a framework considered mutually rational for all participants: scientists, government, business leaders, and NGOs. We call this synergistic intersection “rational convergence.” (more detail and case studies can be found in Save Forests While Making Money: An Avoided Deforestation Carbon Markets Manual by Gabriel Thoumi. School of Natural Resources and Environment, University of Michigan, 2008)

The four primary communities are shown in Figure 2. It is posed that at the interface between the communities that a strategy to negotiate shared benefit is needed in order for problem-solving strategies to converge. It is further posed that a carbon market is the ultimate policy mechanism to reduce the excessive emission of greenhouse gases into the environment. The use of the market explicitly defines that monetary valuation is the common unit around which negotiations are anchored. Therefore, money, with all of its emotional connotations, becomes the lingua franca.

Figure 2: A composite of the communities that are vested in the development of an environmental market to manage carbon dioxide emissions. Figure 2: A composite of the communities that are vested in the development of an environmental market to manage carbon dioxide emissions. |

When market participants make capital expenditures decisions to invest in, for example, new technology, they need to have an expectation that their investment will be paid back. This is an incentive for market participants to pay for switching costs upfront. The natural timescales brought to the market by investors varies widely from, indeed, a few minutes to years. A very long term investment might be one that extends across the wage earning period of a human life, approximately 50 years. More realistically, natural market time scales are a few months to a few years.

This market time scale stands in stark contrast to the time scales associated with reduction of carbon dioxide levels in the atmosphere and the mitigation of global warming. The natural time scales for seeing a benefit from actions to reduce greenhouse gas emissions is many decades to centuries. Similarly, the time scales associated with the impact on ecosystems are very long. Therefore, the market, which functions on natural time scales of months to years, is expected to regulate an environmental impact that is many investment cycles into the future. This is a formidable challenge made more formidable when considering the difficulty of the valuation of environmental assets and ecosystems or the psychology of the self-interested investor investing for future generations.

Expenditures by businesses on infrastructure offer another natural time scale. Relevant examples of infrastructure assets are power plants, petroleum refineries, hydroelectric dams, and bridges and highways. Investments in the energy sector have a payback period of roughly 20 to 30 years. Valuation of carbon will affect equity and debt financing. The ultimate cost of infrastructure expenditures would be highly sensitive to valuation of carbon dioxide emissions. Since the valuation of carbon dioxide arises because of a market generated by policy, it is critical for policy to be stable over decadal time scales. Many of the current markets are linked to the 2012 expiration of the Kyoto Protocol, and this does not meet this criterion. To be explicit, stable policy does not mean stagnant policy.

One important conclusion that arises from this consideration of the natural time scales is that the near-term policies required to develop the market are not likely to transfer directly to the long-term policy that is required for the management of the climate. That is, policy should be viewed as evolutionary. With a population of several billion and energy consumption to support that population, the sustained management of a stable climate will be required behavior.

The significant challenges that arise simply from the intrinsic attributes of market, policy and environment are made more difficult when considering the deficiencies present in the current carbon market (highlighted in the previous section). The present direct correlation between carbon dioxide emissions and economic success must be broken. Energy and climate change need to be de-correlated. Therefore, strategies are required that both help cross the cost gap between fossil fuels and alternative energies (see Figure 1) as well as to develop these energy sources to be extensible across the population. Similarly, strategies to provide valuation to efficiency need to be developed.

A critical need in the development of the market is the need for viable and verifiable abatement choices. Avoided deforestation is one of most effective ways to reduce near-term greenhouse gas emissions (see Reducing Emissions from Deforestation and ecosystem Degradation (REDD) at The World Conservation Union). Therefore, valuation of the holding capability of existing forests is critical. However, looking to the future the ability of the terrestrial and oceanic sinks to remove carbon dioxide from the atmosphere fast enough to stabilize the climate on time scales relevant to humans is not self-evident. The consequences on the ecology of the land and ocean are likely to be enormous. Links to other global-scale environmental challenges like nitrogen fertilization and ocean acidification are not well understood. It is safe to conclude that technology that supports sequestration of carbon under the surface of the Earth will be required.

The lack of knowledge and availability of abatement strategies and the lack of evaluation of efficiency naturally complicate the specification of a cost threshold for shares of carbon dioxide emission. This complexity is amplified by the conflict that arises because of the different time scales for markets, investments, policy, and science. A strategy for going forward requires consideration of all of these factors.

Moving Forward: Integration of Science, Markets, Policy, and Legacy

In the previous section it was argued that the natural time scales associated with markets, investments, policy, and climate change were a useful way to understand the conflict that arises when trying to address the challenges of climate change. In that argument the long-term attributes of global warming were emphasized; namely, any benefits of our actions today will not be realized for many decades, perhaps, centuries. Alternatively, our inactions today will also have impact many decades and centuries from now. Our inactions today will increase the magnitude of response that will be required in the future.

It is known from the Intergovernmental Panel on Climate Change (IPCC) reports over the past 20 years that if we want to limit the CO2 concentration in the atmosphere to be less than two times the concentration that was present in, approximately, 1850, the preindustrial atmosphere, we need to take action now. Convincing arguments have been made that even this limitation to CO2 doubling will lead to “dangerous climate change.” Current behavior and observed emissions show little or no inclination by societies to limit the concentration of CO2 in the atmosphere. Hence, there is a near-term urgency to addressing climate change. This near-term urgency is present even without the consideration of “abrupt” climate change or the consequences from the rapid melting of permafrost and ice sheets.

Ricky Rood. |

Considering the short-term and long-term attributes of markets, investments, policy, and climate change and an evolutionary path towards policy reveals a number of near-term requirements. At the top of the list are strategies to provide evaluation to efficiency. Efficiency is the most effective near-term strategy for reducing energy use and carbon dioxide emission (Realizing the Potential of Energy Efficiency). Valuation of efficiency provides tangible cost and benefit to energy users and, hence, becomes a mechanism to support conservation. One of the most straightforward ways to provide valuation to efficiency is through fees, that is, taxes and credits. Similarly such fees are a natural mechanism to address the cost gap between fossil fuels and less carbon dioxide emitting alternative fuels (Figure 1).

Often a putative carbon market is posed as the alternative strategy to a carbon tax which would discourage use of fossil fuels, or alternatively, tax credits which encourage the use of reduced carbon or carbon-free methods of energy production (see 2007 perspective by William Chameides and Michael Oppenheimer in Science Magazine). This positioning as alternative strategies is based on the idea that the goal of either a market or a fee approach is to provide valuation for the management of the CO2 waste. Fee advocates call out the effectiveness of the fee to define this valuation. Market advocates call out the ability of the market to define the least-cost, maximum-environmental-impact solution to pollutant control. In an idealized case, the cost of either the market of the fee will be the same.

This type of tax is a carbon pollution fee, and is, in fact, a market mechanism. Since the use of a carbon dioxide market follows from a societal imperative exercised through policy, the market needs to be developed. The carbon fee (credit) is, therefore, not an alternative policy mechanism. It is part of the near-term development of the market; it is an effective way to provide valuation to efficiency. It is a way to offer incentives for technological development to cross the cost gap between fossil fuels and alternative fuels. It is a way to development abatement technologies. It is a way to offer disincentives for development of especially dirty forms of fuel. Fees are a mechanism to provide checks and balances to energy policies that promote the development of carbon dioxide intense fuels. Given that energy security and economic success work on much shorter time scales than climate change, energy security will trump the development of rational climate policy. Therefore, cost tension to connect energy and climate management policies is required.

Without the use of a fee-based policy to develop the choices available of fuel production, carbon dioxide abatement, and fungible trading of efficiency credits, the formation of a robust, sustainable carbon market will be slow. A market requires a selection of choices at a marginal cost; a market requires flexibility. The technology development required to aid management of carbon dioxide in the atmosphere also contributes to the development of the flexibility required by the market.

There is the need to develop technology to address the challenges of climate change; however, this does not mean that new technology must be developed prior to addressing the reduction of carbon dioxide emissions. In 2004 Stephen Pacala and Robert Socolow participants in the Carbon Mitigation Initiative at Princeton University posed a number approaches to reduce CO2 emissions over the next 50 years (see Pacala and Socolow article in the journal Science). These approaches used existing technology and actions are naturally grouped into three categories: improvement of efficiency, reduced production of CO2, increased loss of CO2. This fifty year time scale is the same as the time scale for infrastructure expenditures and for accumulation of wealth over a lifetime. This introduces a time scale that is relevant to climate change and consistent with other fundamental time scales.

Because energy use, economic success and carbon dioxide emissions are, currently, intertwined, the management of carbon dioxide and the climate represent both an economic development challenge and the ecological problem of the next hundred years. A carbon market that represents the true cost of energy and the disposal of our waste products in the environment represents a potential long-term policy mechanism for carbon dioxide management. The strong interconnection between carbon dioxide emission and economic success distinguishes the carbon market from other environmental markets used to control pollution. Therefore evolution to that solution is not straightforward; there are a series of necessary steps needed to develop a market.

The analysis converges to a set of conclusions. A stable evolution of policy to support the development of a carbon market is needed. Part of the development of the market is the use of fee-based policy; that is, taxes and tax credits. These taxes help to provide valuation to efficient use of energy, to bridge the cost gap between carbon intensive and carbon free fuels, and to develop viable abatement strategies. The fees also help to provide a useful link between energy policy and climate policy. This recognizes that the urgency of energy policy will trump climate policy, and that there are solutions to energy security that negatively impact the climate. Ultimately, it is required that energy security and climate security be de-correlated if we are going to maintain economic stability on a planet supporting billions of consumers.

Acknowledgements

We thank Rachel Hauser, Andrew Gettleman, and Cecelia DeLuca of the National Center of Atmospheric Research and Paul Higgins of the American Meteorological Society (climatepolicy.org) for their comments on the manuscript. RBR thanks Tom Lyon, Meredith Fowlie, and Justin Felt of the University of Michigan for many useful discussions.

The Authors

Richard Rood is a Professor in the Department of Atmospheric, Oceanic and Space Sciences at the University of Michigan where he teaches atmospheric science and climate dynamics. In 2006 he initiated a cross-discipline graduate course, Climate Change: The Intersection of Science, Economics, and Policy, which has been expanded to address the broader issues of impacts and adaptation. As a member of the Senior Executive Service at NASA, he received recognition for his ability to lead both scientific and high performance computing activities. Gabriel Thoumi was formerly a researcher at the Erb Institute for Global Sustainable Enterprise at the University of Michigan’s Ross School of Business and the School of Natural Resources and Environment. Thoumi is now Forestry Director at MGM International.