U.S. says Brazilian ethanol doesn’t increase food prices, destroy Amazon rainforest

U.S. defends Brazilian ethanol:

Energy official claims biofuel does not increase food prices,

destroy Amazon rainforest

mongabay.com

July 13, 2007

Brazil’s surging ethanol production does not put the Amazon rainforest at risk and is not fueling higher food prices, claimed a U.S. energy official visiting Brazil.

“There is a huge misconception internationally that in Brazil, we’re cutting down the rain forest to (make) fuels, which is not true,” Reuters quoted Dan Arvizu, director of the U.S. Department of Energy’s National Renewable Energy Laboratory. “Done responsibly (ethanol production) does not have to (compete) with food or impact the environment.”

Arvizu’s comments follow similar remarks Monday by Brazilian President Luiz Inacio Lula da Silva. Lula said that “European competitors were trying to undermine Brazil’s biofuels production by raising environmental concerns,” reported Reuters.

Scientists say while rainforest is not directly cleared for sugar cane plantations, expanding production is pushing smallholder farmers into more marginal areas, including the cerrado grassland and rainforests of the Amazon basin.

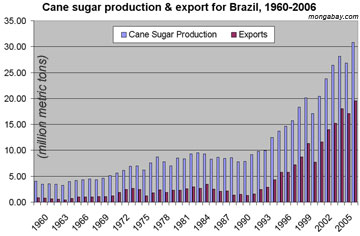

Sugar production in Brazil, 1981-2005. Chart based on USDA data. |

“The high price of petroleum and other factors has driven up the demand for bioenergy, which means that the demand for new agricultural land is growing,” said Dr. Daniel Nepstad, of Woods Hole Research Center’s Amazon program, in an interview with mongabay.com. “We see soy prices going up partly because less soy is being grown in the U.S. As corn expands to meet the surging demand for the emerging ethanol industry. As sugar cane expands in Southern Brazil, soy production is heading northward, encroaching on the Amazon. Soy prices are also inching up because of the new demands for biodiesel (from soy oil). All these are factors drive up the cost of the commodity and basically make it profitable to convert land where it wasn’t profitable a short time ago.”

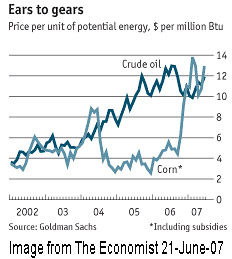

Price per unit of potential energy, dollars per million Btu. Corn price includes subsidies. |

Meanwhile the both the U.N. and the United States Department of Agriculture have warned that booming demand for biofuels has spurred a big jump in food prices over the past year. As the amount of corn used to make ethanol in America has tripled since 2000, corn prices as measured by the unit of potential energy has leapt to equal those of crude oil, according to The Economist. Now that corn prices move in tandem with energy prices, Goldman Sachs analyst Jeffrey Currie says that in order for grain prices to fall, the oil price must fall.

Venezuela and Cuba have echoed these sentiments, specifically criticizing ethanol production in the U.S. (the world’s largest producer of ethanol, most of which is derived from corn) and Brazil (the world’s largest exporter of ethanol, mostly made from sugar cane) for making food less affordable for the world’s poor — Venezuela, as a leading producer of crude, has a strong stake in seeing biofuels, a competitive threat, fail. The country need look no farther than Brazil, with ethanol presently accounts for as much as 20 percent of the country’s transport fuel market and nearly eight out of every ten new cars sold are flex-fuel—capable of running on either an ethanol-gasoline mix (“gasohol”) or bioethanol.

Beyond worries over the environment and “agflation”, some critics have also voiced concern over labor practices on plantations, noting that workers can sometimes be trapped in conditions analogous to slavery. In 2005, 4,133 slaves were freed after Brazilian SWAT-style teams raided 183 farms.

While Brazil and the U.S. having signed an agreement to promote ethanol production in Latin America and the Caribbean, the United States currently imposes a tariff of 54 cents per gallon on most imported ethanol to block imports from Brazil.

Related articles

Amazon rainforest at a tipping point; But globalization could help save it

The Amazon basin is home to the world’s largest rainforest, an ecosystem that supports perhaps 30 percent of the world’s terrestrial species, stores vast amounts of carbon, and exerts considerable influence on global weather patterns and climate. Few would dispute that it is one of the planet’s most important landscapes.

Can cattle ranchers and soy farmers save the Amazon?

John Cain Carter, a Texas rancher who moved to the the Brazilian state of Mato Grosso 11 years ago and founded what is perhaps the most innovative organization working in the Amazon, Aliança da Terra, believes the only way to save the Amazon is through the market. Carter says that by giving producers incentives to reduce their impact on the forest, the market can succeed where conservation efforts have failed. What is most remarkable about Aliança’s system is that it has the potential to be applied to any commodity anywhere in the world. That means palm oil in Borneo could be certified just as easily as sugar cane in Brazil or sheep in New Zealand. By addressing the supply chain, tracing agricultural products back to the specific fields where they were produced, the system offers perhaps the best market-based solution to combating deforestation. Combining these approaches with large-scale land conservation and scientific research offers what may be the best hope for saving the Amazon.

U.S. ethanol may drive Amazon deforestation

Ethanol production in the United States may be contributing to deforestation in the Brazilian rainforest said a leading expert on the Amazon.