What do bikini models and banks have to do with deforestation?

What do bikini models and banks have to do with deforestation?

mongabay.com

May 14, 2006

Report finds banks backing destructive pulp wood projects in southeast Asia; risk to investors

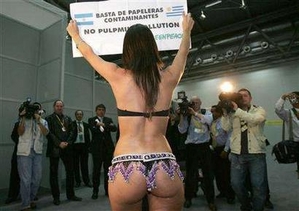

Last week a bikini-clad woman made international news wires when she disrupted a group photo shoot at a business summit in Vienna, Austria. The woman — identified as Evangelina Carrozo, a beauty queen from Gualeguaychu, Argentina — was protesting the construction of two wood pulp plants under construction in Uruguay on the border with Argentina. The $1.8 billion project is the largest investment deal in the history of Uruguay, but has strained relations between Uruguay and Argentina, which says the plant may pollute downstream areas. Earlier this month, Argentina announced it had filed a claim against its neighbor before the International Court of Justice at the Hague, arguing that Uruguay failed to conduct a thorough environmental impact study.

The excitement comes days after the Center for International Forestry Research (CIFOR) released a report critical of the pulpwood industry.

The eight-year study examined 67 pulp mill projects and finds that “false assumptions about the origins and the cost of wood used in emerging market pulp mills has led international investors to channel tens of billions of dollars worldwide into financially risky and environmentally destructive ventures.”

The report—entitled “Financing Pulp Mills: An Appraisal of Risk Assessment and Safeguard Procedures” [PDF (1 MB)]— warns that “a lack of due diligence in the expanding global pulp sector may lead to a new wave of ill-advised projects, setting up investors, forest-dependent communities, and the environment for a precipitous fall.”

“Financial institutions have shown a surprising lack of interest in understanding how the pulp companies requesting loans are going to get all this cheap wood,” said David Kaimowitz, director general of CIFOR. “In reality, some of these mills have vastly overestimated what’s legally available from timber plantations. So the only way they can meet production targets is through unsustainable logging of natural forests or by shipping in wood from distant sources at a much higher cost.”

Evangelina Carrozo of Greenpeace carries a banner protesting the construction of pulp plants in Uruguay. The heads of states of European Union, Latin American and Caribbean were meeting at the ‘IV Summit of the European Union, Latin America and the Caribbean’ in Vienna May 12, 2006. Image copyright REUTERS/Leonhard Foeger. |

|

The report finds that “the scale of pulp mills has grown dramatically over the past decade and that individual mills now have a voracious appetite for wood: a single large mill with an annual capacity of 1.0 million tonnes requires the equivalent of 15 percent of the Brazilian Amazon’s annual timber harvest.”

CIFOR says that “when this wood is not available from plantation forests, the demand for pulp can drive illegal logging and clearing of natural forest ecosystems.” Further, pulp mills can also create water and air pollution–the primary concern of the Greenpeace bikini protestor in Austria.

CIFOR reveals that banks and other financial institutions are partly responsible for deforestation and environmental degradation caused by pulp mills since they “often conduct only minimal due diligence to assess the sources of wood for pulp projects,” The report says that since banks rarely have in-house forestry expertise, they rely heavily on data provided by the pulp producers themselves, significantly increasing financial risk of their projects.

Investor enthusiasm for pulp expansion is driven by China’s enormous demand for paper products: Wood yard and manufacturing facilities at a pulp and paper company in Guanzhou, China. Photo by Christian Cossalter. CIFOR report: “Investor enthusiasm for pulp expansion is increasingly driven by China’s seemingly insatiable demand for paper products, which is projected to reach 68.5 million tonnes in 2010. According to the CIFOR report, this enthusiasm has led investors to ignore overly optimistic projections by companies seeking to raise funds to feed this demand by developing industrial wood plantations. Sino-Forest, a Toronto-listed company with plantation holdings in China, reported in its 2002 annual report that it had access to 232,600 hectares of its own timber plantations. In June 2004, this figure was reported to be 146,000 ha. In 2000 Sino-Forest also reported its intention to develop up to 603,000 ha with local Chinese partners. Sino-Forest would not own these forests, but be entitled to 70% of their wood harvest. It later turned out that there were only 34,000 hectares of joint ventures.” |

|

CIFOR cites two companies in Indonesia, Asia Pulp & Paper (APP) and Asia Pacific Resources International Ltd. (APRIL) as examples where “financial institutions failed to conduct proper due diligence on fiber supply.”

“During the 1990s, APP and APRIL borrowed over US$ 15 billion from international capital markets by telling investors that they have sustainable supplies of very low-cost fiber. However, both companies continue to rely on the clearing of natural forests in Sumatra for 60-70% of their wood supply, and each is still years away from meeting its own plantation development targets,” said Christopher Barr, CIFOR senior scientist and coordinator of the study.

The study adds that China’s insatiable demand for paper is fueling pulp mill expansion and accelerating the loss of biologically rich forests in Indonesia

“The Chinese market is driving a lot of growth in global pulp and paper. And after China — 10 to 15 years down the line — we can see India may be a similar story,” said Kaimowitz.

PT. Kiani Kertas pulp mill in East Kalimantan, Indonesia. Photo by Christian Cossalter. The report says that Merrill Lynch, ANZ Bank, and Cornell Capital are currently working with Singapore-based United Fiber System to secure financing for a deal to purchase and expand the PT Kiani Kertas pulp mill which could place pressures on rainforests in Indonesian Borneo (Kalimantan). Merrill Lynch failed to respond to the charges, according to CIFOR. |

|

While the pulp wood firms continue to destroy forest ecosystems, the CIFOR report says that “a growing number of banks are now adopting policies that require better social and environmental assessments of their forest-related investments.” It cites Dutch banks ABN AMRO and Rabobank, which has recently agreed “not to finance the clearing of primary forest or the purchase of illegally harvested timber.” Further, CIFOR notes that “since 2003 some 41 of the world’s largest lending institutions have endorsed the IFC-sponsored Equator Principles, which commit them to meeting enhanced environmental and social standards in their loans for specific types of projects.” However, the report cautions that “the Equator Principles fail to cover most of the loans and bonds used to finance the expansion of pulp mills.”

“The Equator Principles are an important first step towards raising accountability among global financial institutions for assessing the impacts of the projects they fund,” according to Barr, “However, to have a meaningful effect on pulp mill financing, the Equator Principles must be broadened to cover syndicated loans, and issues of notes, bonds and equity, as well as project finance.”

This article is based on a news release from CIFOR. Its report can be found at Financing Pulp Mills: An Appraisal of Risk Assessment and Safeguard Procedures [PDF (1 MB)]—